The calculations are expained in this video on my youtube channel : How is your income tax calculated ? | 7 Basic steps

Basic Steps in English and French:

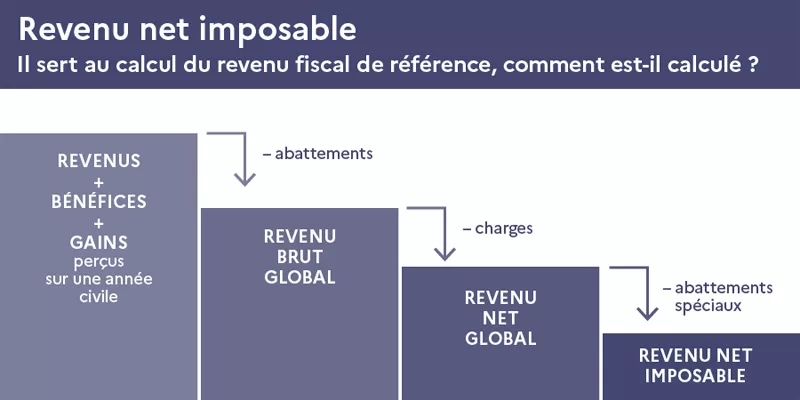

- Total Income or Revenu Global (RG)

- Total Gross Income or Revenu Brut Global (RBG)

- Total Net Income or Revenu Net Global (RNG)

- Net Taxable Income or Revenu Net Imposable (RNI)

- Family Quotient or Quotient Familial (QF)

- Gross Tax to be paid by the household or Impôt Brut (IB)

- Net Tax to be paid by the household or Impôt Net (IN)

Sources:

Disclaimer

- Any finance-related information shared is not professional legal, tax, or investment advice.

- The information provided is of an educational and general nature and is not investment advice within the meaning of Articles L. 321-1 and D. 321-1 of the French Monetary and Financial Code.

- Investment carries risks of loss and past performance does not guarantee future performance.

- For all professional advice, please consult a certified financial planner, CGP, CIF, tax consultant, etc.

If this article was useful, please leave your feedback below