This article is about a community forum to discuss the various personal finance topics such as savings, investments, taxes, etc in India and France. It was created to provide a private platform for financial discussions between the Indian community living in France.

Personal finance is a very vast subject. So, the discussions in this group are limited to the topics about India and France. Also, based on the DTAA between the two countries. So, discussions about other countries and question from other nationalities are outside the scope of this group.

All discussions between the group members including the admin are for educative and financial awareness purposes only. They should not be considered as professional financial advise.

You can join the telegram group using the Invite link above and also access all the previous discussions since the creation of the group. The admin will approve the requests to join, on a case-by-case basis.

After joining the group, please introduce yourself with the following information.

- Name (first name only for privacy reasons)

- City in France

- Purpose of joining the group

Topics Covered

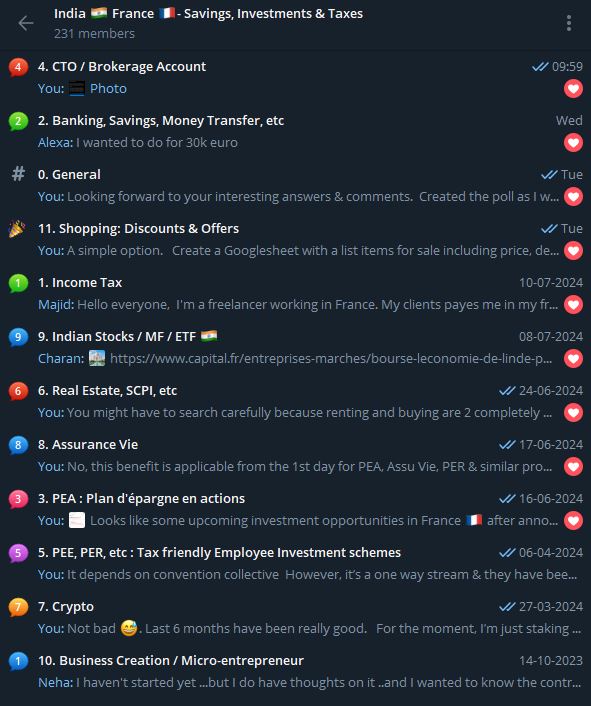

The group covers various subjects related to personal finance. You can find the introduction and general discussion in the chapter 0. General . It has links to the various topics highlighted as chapters below.

The following chapters are currently available in the group.

- Income Tax, DTAA, etc

- Banking, Savings, Money Transfer, etc

- PEA: Plan d’épargne en actions

- CTO: Brokerage account (Equivalent of Demat account in India)

- PER: Retirement Investment & Tax reduction

- Real Estate, SCPI, etc

- Crypto

- Assurance Vie

- Indian Investments / Stocks / ETF / MF

- Business creation / Micro-entrepreneur and related topics

Additonal chapters will be added, whenever required.

Disclaimer

- This is a community group to help each other and share knowledge.

- Any finance-related information shared is not professional legal, tax, or investment advice.

- The information provided is of an educational and general nature and is not investment advice within the meaning of Articles L. 321-1 and D. 321-1 of the French Monetary and Financial Code.

- Investment carries risks of loss and past performance does not guarantee future performance.

- For all professional advice, please consult a certified financial planner, CGP, CIF, tax consultant. etc.

- Any spams including business advertisements are strictly prohibited. Group members not respecting this rule, will be removed without any explanations.

- Discussions are strictly limited to personal finance topics.

- Language of communication should be in English and French. Admin cannot be held responbile for any financial disputes between the group members, inside and outside the group.

Hi Prashanth,

I have few queries regarding first year income declaration in France.

I have come to France on August 2023, before reaching France I was getting salary in India and TAX got deducted there, my question is do I need to show that income again in France, if yes how to get my income tax back?

2. In which French form should I declare capital gain received in India?

3. For first time declaration without French Tax number, do I need to submit my company work contract or just pay slip is enough?

Hello Ashok,

1. Income earned before coming to France is irrelevant for French tax declaration.

2. https://prasanthragupathy.com/2024/03/tax-list-of-income-tax-declaration-forms-in-france/

3. https://prasanthragupathy.com/2024/02/tax-how-to-do-your-first-income-tax-declaration-in-france/

FYI https://prasanthragupathy.com/2024/04/tax-should-i-declare-the-income-earned-before-moving-to-france/

Thank you very much Prashanth, Is it ok if I declare my bank accounts in next financial year? or it is mandatory to declare all the accounts in the first time filing?

Hello Ashok,

You must declare all the accounts now except the ones opened on or after 1st Jan 2024. They must be declared next year.

Please refer to the detailed explanations here https://prasanthragupathy.com/2024/03/tax-form-3916-declaration-of-foreign-bank-insurance-and-investment-accounts/

Thank you Prashanth, as per online we have to fill 3916 form for each bank account we hold outside France, so If I have more than 1 bank account then I should taken multiple similar forms and submit offline.

Yes & this has been explained on the 3916 article too.

Hi Prashant

I would like to know if you have any tutorial for how to do the déclaration prospective to calculate the PAS taux and get the fiscal number

Thank you for your help

Best regards

Hello Arva, please refer to this post https://prasanthragupathy.com/2024/02/tax-how-to-do-your-first-income-tax-declaration-in-france/

Hi Prashanth,

I hope 2024 forms (for 2023 financial year) are not published yet, you have mentioned this information in your post but you have also mentioned links to 2024 forms, just got confused.

Do we need to wait for new forms or continue with old forms for tax filing?

The links are the same every year. Only the content inside is updated.

The tax forms for 2024 aren’t yet published by Impots.

Can we submit the declarations using old forms or should wait till new forms are released?

French Tax Forms are unique for each year. So, you must wait

Ok, Thank you Prashanth for your responses, I really appreciate for your patience, answering all my queries, I will wait for the documents.

Hello Prasanth,

Thanks for this great article. I have a question regarding investment made through apps such as Etoro/traderepublic etc.).

Context:

I have money invested in stocks and bonds via these fintech apps. I have not taken any money out of them. So entire investment stays still in the app.

These accounts (associated to apps) are already declared in the form Form 3916 as they are all foreign national accounts.

I have certain stocks for which I received dividends which is sent directly to my current account from app.

Question:

1. Do i need to declare the amount that i invested in the apps (gains) in taxes Form 2047 & 2042 ?

note: Money is still in the app account except the dividend amount

2. Dividend that i received from app to my current account, do I need to use the form 2047 & 2042 ?

3. Can you guide me to an article that you might have written on the rules that applies to the apps like Etoro etc. in the context of tax.

thanks in advance

Hello Siddharth,

First, feel free click on the link inside this article and join the Indian personal finance discussions group. I ave discussed tese topics in detail.

Also FYI, a video tutorial https://youtu.be/abdlGi3J5nw and https://prasanthragupathy.com/2024/04/tax-income-tax-declaration-video-tutorial-france-online-2024/

1. You must declare these accounts in 3916. Not the capital invested https://prasanthragupathy.com/2024/03/tax-form-3916-declaration-of-foreign-bank-insurance-and-investment-accounts/

2. Yes, foreign dividends;, interest and capital gains via 2047 & 2042. https://prasanthragupathy.com/2024/04/tax-how-to-declare-your-foreign-bank-interest-income-in-2047-2042-tax-forms/

3. Refer to the discussions inside the group.

Hi Prasath, How can we declare PEG savings in our taxes? Does it fetch any benefit or return?

Hello, It depends on what was added in the PEG account. Please refer to “Quelle est la fiscalité du PEE ?” in https://www.service-public.fr/particuliers/vosdroits/F2142

Sir I am doing masters in ISEP 2024-2026 can I apply for scholarship…can I get 2 years if I am eligible?

Hello Anil, You cannot get it for M1 because it must have been applied last year. For M2, you can try now. Check with your college too.

The applications to Charpak scholarships for current September start the previous November. For Sept 2024 intake, the applications started in Nov 2023.