Summary of the Federal Reserve Press Conference on 13th December 2023.

FOMC leaves interest rates unchanged for the 3rd consecutive time in the 5.25% – 5.50% range.

- Continue to reduce securities holdings at a brisk pace as indicated in the Decisions Regarding Monetary Policy Implementation

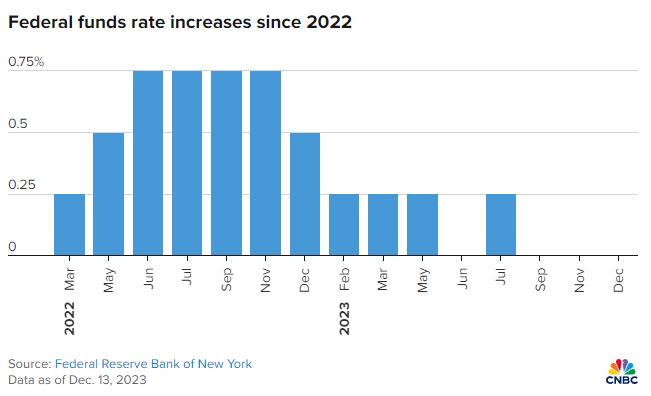

- 3rd consecutive meeting that the Federal Open Market Committee (FOMC) chose to pause the interest rates hikes.

- Since March 2022, there have been 11 rate hikes, including 4 in 2023.

- “Inflation has eased over the past year”, indicating a temporary victory over inflation.

- None of the FED officials forecast any rates hikes next year but members indicated at least 3 rate cuts in 2024, probably multiple 0.25% point rate cuts.

- If the economy evolves as projected by FOMC participants, the median projection of the federal funds rate will be 4.6% at the end of 2024, 3.6% at the end of 2025, and 2.9% at the end of 2026.

- Strongly committed to returning inflation to its 2% objective.

Highlights of the FOMC press conference

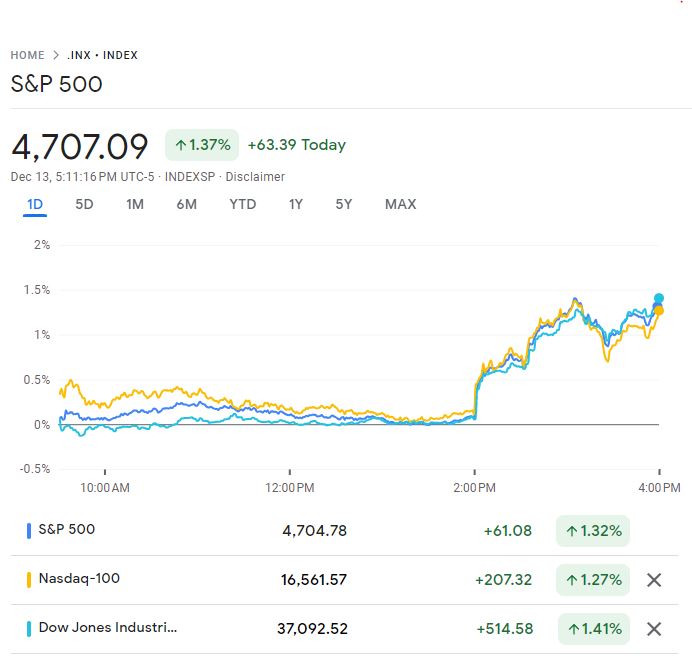

Wall Street reacted positively with S&P500, Nasdaq100, and Dow Jones Industrial Average Indices rising by 1.32%, 1.27%, and 1.41% respectively after the meeting. Stocks Surge on FOMC Meeting Results

References

- Transcript of Chair Powell’s Press Conference Opening Statement December 13, 2023

- The official press release from the United States Federal Reserve from 13th Dec 2023 Federal Reserve issues FOMC statement

- The Decisions Regarding Monetary Policy Implementation Implementation Note issued September 20, 2023

- Economic projections from the December 12-13 FOMC meeting

- FOMC – Meeting calendars, statements, and minutes (2018-2024)

- CNBC News – Fed holds rates steady, indicates three cuts coming in 2024

- Reuters News – Fed flags end of rate hikes, sees drop in borrowing costs in 2024

Disclaimer

- Any finance-related information shared is not professional legal, tax, or investment advice.

- The information provided is of an educational and general nature and is not investment advice within the meaning of Articles L. 321-1 and D. 321-1 of the French Monetary and Financial Code.

- Investment carries risks of loss and past performance does not guarantee future performance.