An ETF (Exchange Traded Fund) is a basket of investment options such as stocks, bonds, commodities like gold, etc. It allows buying a group of stocks in a single transaction, without the need to buy these stocks individually. ETFs are known for their very low expense ratios and broker commissions.

This article focuses on S&P500 Index and the ETFs tracking the index.

Some quick facts – S&P500 Index

| Launch Date | 4th March, 1957 |

| Country | United States |

| Stocks | 500 large-cap companies in US, which cover 80% of the investable market capitalization. |

| Weighting Method | Float-adjusted market cap weighted |

| Currencies | USD, AUD, BRL, CAD, CHF and EUR |

| Rebalancing Frequency | Quarterly in March, June, September, and December |

| Weightage of Top 10 stocks | 30.90% |

1. What is a S&P 500 Index ?

The S&P 500 Index, launched in 1957, is a well known benchmark which measures the performance of 500 leading companies in United States and covers approximately 80% of the available market capitalization. This includes top global companies like Microsoft, Apple, Nvidia, Amazon, Meta, Tesla, Berkshire Hathaway, Home Depot, Visa, etc.

The index is based on the S&P U.S. Indices Methodology– China, India, Indonesia, Korea, Malaysia, Philippines, Taiwan and Thailand.

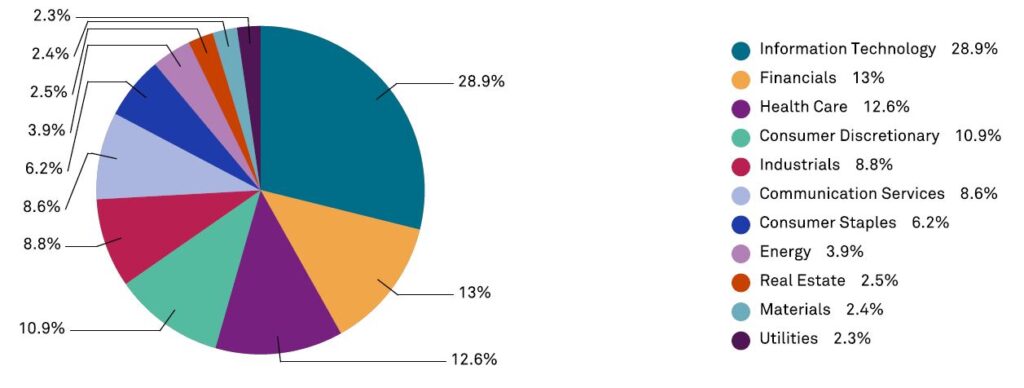

You can find the top-20 stocks and sector-wise allocations in the charts below.

Top 20 Constituents by Index Weight

| Stock | Weightage (on 17th Jan 2024) |

| MICROSOFT CORP | 7.27% |

| APPLE INC | 6.71% |

| NVIDIA CORP | 3.48% |

| AMAZON.COM INC | 3.47% |

| ALPHABET INC CL A | 2.10% |

| META PLATFORMS INC CLASS A | 2.05% |

| ALPHABET INC CL C | 1.79% |

| BERKSHIRE HATHAWAY INC CL B | 1.64% |

| TESLA INC | 1.50% |

| ELI LILLY + CO | 1.26% |

| UNITEDHEALTH GROUP INC | 1.22% |

| BROADCOM INC | 1.22% |

| JPMORGAN CHASE + CO | 1.21% |

| VISA INC CLASS A SHARES | 1.07% |

| EXXON MOBIL CORP | 0.98% |

| JOHNSON + JOHNSON | 0.97% |

| HOME DEPOT INC | 0.89% |

| MASTERCARD INC A | 0.99% |

| PROCTER + GAMBLE CO | 0.88% |

| COSTCO WHOLESALE CORP | 0.76% |

| Total | 41.46% |

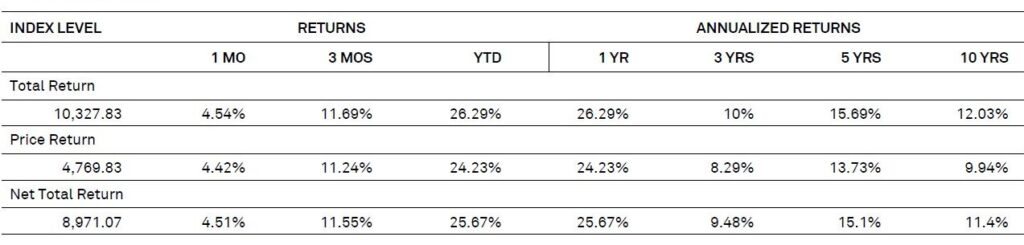

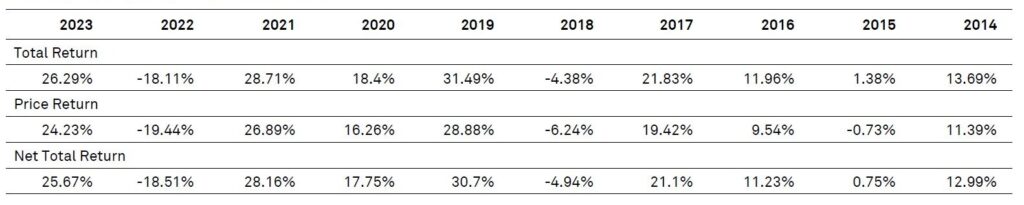

2. S&P500 Index’s performance ?

The S&P500 Index has given an annualized gross return of 12% in the last 10 years. You can refer the Factsheet (USD, EUR,- etc) for more details.

Annualized Returns

Performance History since inception

Calendar Year Performance – Last 10 years

3. How to invest in S&P500 Index ?

There are multiple ETFs which track the S&P500 EM Index. These ETFs invest in the stocks, which are part of the index. So, the performance of the ETFs should be very close to its benchmark index. A concept known as tracking error measures the deviation in performance of the ETF and its index. So, you should choose the ETFs with the lowest tracking error.

Various assets management companies such as Vanguard, Fidelity, Amundi, Blackrock (iShares), Invesco, etc have their S&P500 ETF versions.

There are normally 2 types of ETFs,

- Accumulating (ACC) / Capitalisation (C): Dividends are reinvested automatically.

- Distribution (Dist) / Distribuant (D or DR): Dividends are paid to the investors.

It is highly recommended to invest in the accumulating ETFs, so the dividends are reinvested. This helps your investments to keep compounding over time and also avoid the flat tax on dividends every year.

You can invest in a S&P500 Index ETF via the following accounts, depending on where you live.

3.1. Various type of Brokerage Accounts

The ETFs can be invested via the regular brokerage accounts (CTO in France). You can open these account with the regular banks and also brokers such as Boursedirect, Degiro, Fidelity, Interactive Brokers, Robinhood, Trade Republic, Trading212, etc. Some of these ETFs may not be available with all these brokers. So, choosing a right broker is very important.

You can find all the ETFs tracking the S&P500 Index here Index-Linked Products

3.2. Retirement Accounts & Insurances

If your retirement acounts like 401k (US), IRA (US), RRSP (Canada), PER (France), etc and special savings accounts like Assurance vie (France) have these ETFs, you can choose them. So, this is one of the important points to check while opening these type of accounts. This will help you to save some taxes and have a decent portfolio during retirement.

3.3. PEA (France)

The Plan d’épargne actions (PEA) is a regulated savings and investment account available only to residents in France. It makes it possible to acquire and manage a portfolio of shares of European companies, while benefiting from certain tax exemptions.

If you are living in France, a PEA account should be your primary option for investing in shares, ETFs, etc. This account can be complimented by a CTO account, especially for securities which are not available in the PEA.

There are currently 2 S&P500 Index ETFs, which can be invested using a PEA account.

- Lyxor PEA S&P 500 UCITS ETF – Capi

- Amundi PEA S&P 500 ESG UCITS ETF Acc (ESG version which tracks the S&P 500 ESG+ index)

4. Does S&P500 Index ETF pay dividends ?

The S&P500 Index has hundreds of companies that pay ample dividends. So, the ETFs tracking the S&P500 Index will pay dividends too. The dividends are usually paid quarterly and so 4 times a year.

- If you have a chosen an accumulating ETF, these dividends will be reinvested.

- If you have a chosen a dsitributing ETF, these dividends will be paid to your brokerage account periodically.

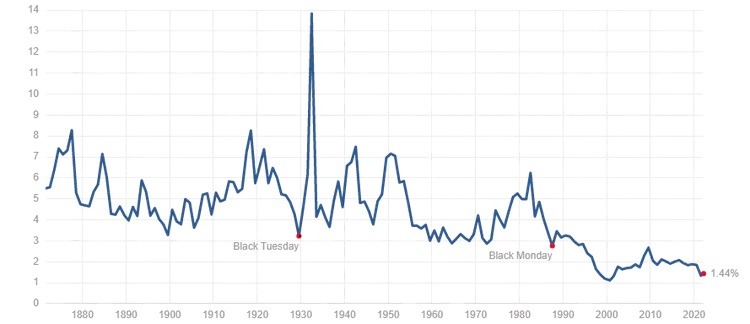

The average dividend yield from a S&P500 Index ETF is currently 1.50% and the long term average is 1.84%. From its recent peak of 3.86% in 2008, the dividend yield is currently hovering around 2% on average.

The S&P 500 index’s dividend yield has gradually decreased and this shows that these companies are paying out lower dividends or have stopped paying them.

5. How much S&P500 Index ETF for our portfolio ?

Though, S&P500 Index ETFs invest in the top 500 US companies, there is a high concentration risk of investing in a single country. So, there is an ample scope for diversification with other ETFs outside US. We can also invest in other developed markets, specific sectoral ETFs, individual countries, etc.

The percentage allocation to S&P500 Index in our portfolio depends on various factors such as asset allocation, risk tolerance, personal goals, where we live, overlapping, etc. Some people invest in just one S&P500 Index ETF while others add a few more Index ETFs for diversification.

6. Other options for Index ETFs?

Here is a list of other Indexes which can complement the MSCI EM Index. You can invest in the various ETFs tracking these indexes.

- MSCI World Index, which invests in around 1,500 companies across 23 developed countries.

- MSCI Emerging Markets Index, which invests in 24 developing countries and consists of around 1,400 large and mid-cap companies from these emerging economies.

- Nasdaq-100 Index, which invests in 100 of the largest non-financial tech companies listed on the Nasdaq Stock Market.

- Dow Jones Industrial Average Index, which invests in 30 U.S. blue-chip companies and covers all industries except transportation and utilities.

- Euro Stoxx 50 Index, which invests in 50 largest companies in the Eurozone and covers 20 sectors.

- FTSE 100 Index, which invests in the top 100 companies listed on the London Stock Exchange.

This list is non-exhaustive because there are too many market indices.

Support This Blog!

If you’ve found my articles helpful, interesting or saving your time and you want to say thanks, a cup of coffee is very much appreciated!. It helps in running this website free for the readers.

7. References

- S&P 500 Index

- What Is an Exchange-Traded Fund (ETF)?

- A Brief History of Exchange-Traded Funds

- International ETF: What It is, How It Works, Example

- 10 ETF Concerns That Investors Shouldn’t Overlook

- ETF vs. Mutual Fund: What’s the Difference?

- Index Fund vs. ETF: What’s the Difference?

- Building an All-ETF Portfolio

Disclaimer

Any finance-related information shared is not professional legal, tax, or investment advice. The information provided is of an educational and general nature and is not investment advice within the meaning of Articles L. 321-1 and D. 321-1 of the French Monetary and Financial Code. Investment carries risks of loss and past performance does not guarantee future performance. For all professional advice, please consult a certified financial planner, CGP, CIF, tax consultant, etc.