An income tax declaration requires a tax identification number (TIN). In France, TIN is known as ‘numéro fiscal’ or “numéro d’identification fiscale” (NIF). If you do not have this number, you are in the right place. This article is written for people who will be doing their first income tax declarations in France.

Income Tax declaration is done during the current year for the income earned in the previous calendar year. The French tax declaration season opens every year from April to June. For example, the 2025 income tax declaration is done for the income earned from January to December 2024. The declaration period starts from 10th April 2025.

Note: If you have reached France after the tax season, you can follow the same procedure explained below. The local tax office will either process your documents and allocate a Tax ID or ask you to wait until the next tax season. The above is relevant only for the creation of the French Tax ID and the online account in Impots. Actual tax declaration can only be done the following year.

Documents Required

You need to collect the following documents for your income tax declaration.

- Form Formulaire 2042 : Déclaration de revenus It is the main tax declaration form.

- Annexure Form Formulaire 3916-3916-BIS . This form allows you to declare all your non-French accounts from banks, insurance, crypto exchanges, etc.

- Other annexure forms apply to your situation. The most common ones are 2042 RICI (Tax credits & reductions), 2047 (Foreign income) and 2074 (Profit or loss from investments).

- Copy of your passport and a valid French resident permit. If you are an European citizen, copy of your EU identity card.

- Copy of a valid address proof in France. So, it can be a rental contract, rent receipt, an attestation d’hebergement, etc and an utility bill less than 3 months old like gas, electricity, landline, mobile number, etc. Please refer to Address proof documents for Resident Permits: Justificatif de domicile.

- Copy of your French Bank RIB (relevé d’identité bancaire) which has your complete bank account details. It can be downloaded from the documents section on your bank’s website or mobile application.

For a complete list of French Income Tax Forms, please refer to List of Income Tax Declaration Forms in France.

Tax Declaration Process

First-time declarations in France cannot be done online, except when you have obtained your Tax ID and the online login credentials in advance. So, the paper-based declaration documents have to be sent by post or directly dropped into a box at your local tax office. This can be done during the tax season (April – June) on or before 21st May 2024.

The French Tax ID will generated during the processing of your tax declaration.

Step 1: Preparing the documents

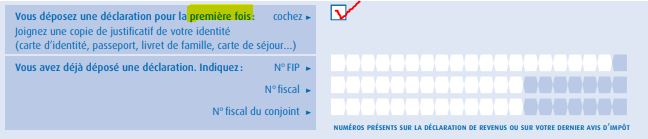

For your first income tax declaration, you do not need a numéro fiscal (Tax ID) because you can tick the box next to “Vous déposez une déclaration pour la première fois” on the main tax form 2042.

Did you know? When your paper declaration is processed around August or September, the tax department “Impots” will generate your tax ID too. Even if you manage to get a tax ID in advance, it doesn’t really help.

Then, you should continue completing the entire 2042 form manually with all your details like personal information, address, income, any capital gains, tax credits, tax reductions, etc. You should also attach relevant annexure forms applicable to your situation like 3916, 2047, 2042 RICI, etc.

If you have any specific questions about completing these tax forms, please ask directly in the comments section. You can also visit your local tax office or a France Services office to ask your questions, with or without appointments.

Step 2: Submitting the documents

When your declaration is complete with all the annexures and supporting documents, you need to start searching the postal address of your local tax office.

You can use the search option on Service Public website or simply google “SIP + City Name” and find your local tax office. When you have found your tax office address, you need to send the documents by a registered post or simply walk in and drop the documents.

Here is an example for Toulouse.

Related Articles

- Tax : French Income Tax Declaration Deadlines In 2024 For AY2023 Income

- Tax : French Income Tax Brackets And Tax Rates In 2024

- List Of English-Speaking Finance & Tax Advisors In France

- Double Tax Avoidance Agreement (DTAA) Between France And Various Countries

- What Is France Services ? Government In Proximity

Support This Blog!

If you’ve found my articles helpful, interesting or saving your time and you want to say thanks, a cup of coffee is very much appreciated!. It helps in running this website free for the readers.

Sources & References

- What is the NIF (TIN in English)?

- Impôt sur le revenu : tranches et taux d’imposition 2024 Service-public.fr

- Quel est le barème de l’impôt sur le revenu ? Service-public.fr

- Quotient familial et impôt sur le revenu : comment ça marche ? Economie.gouv.fr

- Pouvez-vous bénéficier de la décote de l’impôt sur le revenu ? Economie.gouv.fr

- Calculation of income tax Code général des impôts : articles 193 à 199

- Amount below which tax is not collected Code général des impôts : articles 1657 à 1659 A

- Bofip-Impôts n°BOI-IR-LIQ-20 relatif au calcul de l’impôt sur le revenu

- How to calculate your income tax according to the income tax brackets & rates ? Economie.gouv.fr

Disclaimer

Any finance-related information shared is not professional legal, tax, or investment advice. The information provided is of an educational and general nature and is not investment advice within the meaning of Articles L. 321-1 and D. 321-1 of the French Monetary and Financial Code. Investment carries risks of loss and past performance does not guarantee future performance. For all professional advice, please consult a certified financial planner, CGP, CIF, tax consultant, etc.

Updated 12th March 2024

I am driver har in dubai I have licence UAE 9yar experience tax driver I move your cantry do you halp me I need to work

Hello ,

I have my first tax declaration 2023 NOV which is late. I never got a tin. But recently I tried to connect via mes droits and using france connect I saw I was able to get impot login with doc saying

Impôt sur les revenus de 2022

Avis d’impôt établi en 2024

CENT.

Question:

Is the numero fiscal on this my tin ?

Thank you

Hello Shivaraj, Did you see the 1st line of this article?.If No, please do the same.

Thanks in advance.

Hello,

I am new to France and started working from Feb-2024 onwards.

Do i Need to file Income Tax?

If yes, which form will be applicable 2042/2042RICI/2047?

If no, then how to Obtain Fiscal number?

Hello Raj,

In your case, you can just do a zero tax declaration using the 2042 tax form. This will generate the tax ID and will allow you to submit an online declaration next year.

Hi Prasanth!

I’m an apprentice currently, declaring revenue & tax for the first time. I wanted to know if I can declare student loan back in India & get the Net Imposable reduced? I checked Form 2042 RICI for reduction, but didn’t find any suitable field. I’d really appreciate your inputs, thanks a lot!

Hello Aditya,

Unfortunately, Indian loans do not qualify for any tax benefits in France.

In the section “attestation d’hébergement”, should we fill the details of the house owner and get their signature or should we fill our details and attach the rental contract?

It is just a template and not mandatory to fill, if you have all the supporting documents mentioned on this post.

Hi Prasanth,

For the French tax returns, do we need to specify Indian Capital Gain tax or dividend income, interests etc? Its my first time French tax returns.

Or in income section of form 2042 I mention only the French income as seen in my salary slip?

Hello, Yes all the income from India must be declared in 2047 annexure and carry-forwarded to the respective lines in the main tax form 2042.

A have explain a few topics here.

https://prasanthragupathy.com/2024/03/tax-form-3916-declaration-of-foreign-bank-insurance-and-investment-accounts/

https://prasanthragupathy.com/2024/04/tax-declaration-of-indian-income-in-france-based-on-dtaa/

https://prasanthragupathy.com/2024/04/tax-how-to-declare-your-foreign-bank-interest-income-in-2047-2042-tax-forms/

Hello, thank you for the reply. But it is bit confusing for me. I am already paying my taxes in India (Filing ITR) on capital gains, dividends, interests etc. In France I am on salary. So why do I have to mention my Indian income for which I have already filed the ITR

Please refer to this article which explains this topic in detail

https://prasanthragupathy.com/2024/04/tax-declaration-of-indian-income-in-france-based-on-dtaa/

Hi I have a question.

I worked for a few months in France (October 2023 – April 2024), Now i have moved to Belgium. I currently don’t have any address in France. How should I provide accommodation details in France?

Hello Vinay, please refer to this video tutorial https://youtu.be/6ku8Qmxplt4

Hey, I am a bit late on filing my first tax. Will it be processed if I still went there physically and filled the forms. I need TIN number to open my NRE account back in India.

Hello,

You are already late. Submit it asap. Going to the tax office is not going to change anything. The tax returns will be available only from end of July.

Hi , i have enquired at my nearest tax office to file first time tax through offline and they agreed to submit it now and so am filling the forms and having few doubts. Can you help me.

1. On Jan 01st 2024 i was staying in a place where the person provided me the “attestation d’hébergement” and i have signed copy with me. And from March 01st 2024 i moved to a new place where i have the proper rental contract and rent receipts. My 1st question is that in Tax form 2042 where there is a dedicated section for “attestation d’hébergement” they have asked to get the signature from the person hosted me in Jan. He already left Paris in April 2024. Do i still need to fill that section? as i have the signed “Attestation d’hébergement” which i got from the person during my stay.

2. Am married and having 2 kids, but am staying alone in Paris and am not going to bring my wife/kids to Paris. Do i still need to fill my wife/kids details in the form? and am aware that am not going to get any benefits as they are not direct dependant in Paris.

Hello, I have already explained these topics in detail.

1. Check address part from 02:00 mins https://youtu.be/6ku8Qmxplt4?feature=shared

2. https://prasanthragupathy.com/2024/04/tax-declaration-when-one-spouse-is-living-outside-france/

Hi Prasanth,

Thank you for the detailed articles. I have gone through a few of them.

I have been living in France since August 28, 2024, as a student with virtually no income. However, I would like to file my income tax returns here.

You mentioned that to obtain the TIN/NIF number, one should have sent in the physical copies of the forms by April-June 2024. Given that it is now December 25, 2024, can I still apply for and receive my tax ID, or should I wait and apply for my TIN next year?

Hello Sharad,

You can try & send the docs by post to your local tax office. But they might either accept it or ask you to wait until the next tax declaration season in April-June 2025.

Cheers,

Prasanth

Hello, i have started working in France from 20th Dec 2024.

I know tax filling date is not opened yet for the income of 2024

But I just wanted to know if I can apply for TIN number/ TAX ID now? So that I can file returns once the window is opened.

Thanks

Hello Naga,

You can try your luck with your local tax office. Either your request will be processed or asked to wait for the 2025 tax season.

Cheers,

Prasanth

Hi Prasanth,

I am preparing to file my first tax return in France and have a few questions:

1. I am married with two children. My second child was born in India and will be arriving in France in June 2025. Should I include their details in the income tax form at this stage?

2. My wife and first child hold French residence permits (valid until June 2028), but they have been in India for the past six months and will return to France in June 2025. Do I need to include their details in the income tax form now?

Thank you very much for your assistance – I really appreciate your guidance!

Hello Swapnil,

You can declare your spouse & 1st child in your joint tax declaration because all 3 can be considered as French tax residents.

But the new born has never been to France and so cannot be declared as a tax resident yet. Feel free to contact your local tax office and get an official confirmation.

Cheers,

Prasanth

PS: If my articles and answers are helpful, please leave your feedback on Trustpilot

Hello,

Is the main income tax form available for 2025 yet? I am not able to find it on this website (https://www.impots.gouv.fr/formulaire/2042/declaration-des-revenus)

Thank you

Hello Shruthi,

The main tax form 2042 for offline declarations is not yet available.

Cheers,

Prasanth

I am working in France from 2022 Jan till now and I haven’t submitted my tax returns. Can I file for two years in 2025?

If yes, do I need to follow any process for it ?

Thanks

Siva

Hello Siva,

You can submit your 2025 tax declarations + corrections for 2024 declaration (2023 income) & 2023 declaration (2022 income).

Exactly why I have listed last 3-year tax forms in this article https://prasanthragupathy.com/2024/03/tax-list-of-income-tax-declaration-forms-in-france/

Create a separate clearly named package for each year & submit everything together. Please follow the instructions in the above article.

Cheers,

Prasanth

PS: If my articles and answers are helpful, please leave your feedback on Trustpilot

Hello Prasanth,

I want to do tax return first time in France. I moved in a new place in France. Do I need to mention my new address as address proof or old address is okay for that? Do they send any letter to the old address if I provide the old address?

Thanks in advance.

Hello Sangita,

Please refer to my detailed explanations in the following income tax tutorial

How to submit your first Income Tax Declaration offline? || Form 2042 || France

https://youtu.be/6ku8Qmxplt4

Cheers,

Prasanth

PS: If my articles and answers are helpful, please leave your feedback on Trustpilot

Update: 2025 year version of the main tax form 2042 was published today.

More details in https://prasanthragupathy.com/2024/03/tax-list-of-income-tax-declaration-forms-in-france/

Hi Prasanth.

I got married last November (2024). And I have mentioned that on page 2 of form 2042. As it is the first time declaration, I am submitting the documents physically.

Am I supposed to put wife’s name in déclarant 2 or should I select the option ‘Vous optez pour la déclaration séparée de vos revenus 2024’ ?

(currently my wife lives in India, and she will be coming to France next year (Feb 2026) only.)

Hello Jainish,

When your spouse is not living in France, she is not a French tax resident. So, please refer to my detailed explanations in Tax: Declaration When One Spouse Is Living Outside France https://prasanthragupathy.com/2024/04/tax-declaration-when-one-spouse-is-living-outside-france/

Cheers,

Prasanth

PS: If my articles and answers are helpful, please leave your feedback on Trustpilot

Hello,

Thank you very much for this informative guide. I have a few questions regarding my income tax filing:

1. This is my first time filing an income tax return in France, and I have two bank accounts here. In the “Coordonnées Bancaires” section of form 2042, should I provide the RIB of only one account (specifically, the one where I receive my salary)?

2. I have taken a student loan from a French bank and have declared it in Form 2062. I would like to know if I am eligible for any tax deductions related to this loan. I couldn’t find a relevant section for such a deduction in Form 2042 or 2042 RICI. Could you kindly confirm whether any tax benefits apply in this case?

3. Is it okay to just submit the rental contract as proof of address or should I also attach “Quittance de loyer” since the contract is more than 3 months old?

TIA.

Kind regards,

Aashray

Hello Ashray,

1. Yes, one bank account details for the refund & tax payments.

2. Personal Loans from bank aren’t considered as taxable income and so a declaration is not required. It’s applicable if you borrowed it from someone.

No tax benefit in either case.

3. Rental contracts are often older. So, it’s always recommended to submit something not older than 3 months such as rent receipts & utility bills. Same as explained in https://prasanthragupathy.com/2024/07/address-proof-documents-for-resident-permits-justificatif-de-domicile/

Cheers,

Prasanth

PS: If my articles and answers are helpful, please leave your feedback on Trustpilot

I had two questions regarding my first French tax declaration:

Since this is my first time filing taxes in France, can I declare both my 2023 and 2024 income together using the paper Form 2042? If I tick the box “Vous déposez une déclaration pour la première fois” on the form, will the tax authorities still issue me a single numéro fiscal, even though I’m filing for two years at once?

In 2024, I worked as a cross-border intern in Luxembourg while residing in France. I paid taxes and filed my return in Luxembourg accordingly. Should I declare this income as foreign income on the French return, and would I have to pay taxes in France again, or is there a way to avoid double taxation?

Thanks!

Hello Meghan,

1. In this case, you are supposed to create separate declarations using 2025 & 2024 tax forms https://prasanthragupathy.com/2024/03/tax-list-of-income-tax-declaration-forms-in-france/

Create separate folders for the 2 declarations & submit them together.

A single numéro fiscale will be created for you.

2. As long as the internship was required to complete your course & the salary was less than 21273€, it’s exempted completely. So, there is nothing to declare about it in France.

Cheers,

Prasanth

PS: If my articles and answers are helpful, please leave your feedback on Trustpilot

Hello Prasanth

Thank you for this informative article. Very helpful.

I have a question. while filing the tax in 2025 for the income earned in 2024, should I consider the salary received for the month of Dec 2024 (received on 02 Jan 2025). Is this Dec 2024 salary to be considered for 2024 tax file or to be considered in 2025 Tax file.

the line – ‘ the 2025 income tax declaration is done for the income earned from January to December 2024. ‘ was clear to me with the understanding that I have to consider salary earned till Dec 2024 though payment received on 02 Jan 2025, but got confused when received feedbacks from others.

Thank you in advance for the response.

Hello Aswathy,

If I was in your situation, I will declare it as Dec 2024 income in the 2025 declaration.

Cheers,

Prasanth

PS: If my articles and answers are helpful, please leave your feedback on Trustpilot

Hi Prasanth,

Thank you for your articles. I am doing my first Income Tax declaration in France and your articles and videos are really helpful. I have a question and will be great if you can give me some input on that. I have a couple NSCs with Indian Post Office and a recurring deposit in a Bank in India, do I need to declare the interest from them for the year 2024 or I can just declare it when they mature and the amount comes my bank account in India.

Thank you!

Atanu

Hello Atanu,

Any income including bank interest received during 2024 must be declared in the 2025 income tax declaration.

Please refer to my 2 detailed video tutorials on this topic.

Cheers,

Prasanth

PS: If my articles and answers are helpful, please leave your feedback on Trustpilot

Hi Prasanth, I hope you’re doing well. Thank you for the detailed video and the article. It was very helpful. I have a doubt on my side, which is a bit complicated. I am extremely sorry in advance for the long text that I am going to send you. I came to France as a Student in September 2023. And I left for an exchange semester in Vietnam in April 2024 and only returned back to France in August 2024. So I never filed an income tax for the year 2023 (0 tax declaration). Then I started my 1st internship Sept 2024 till Feb 2024. Following that I’m continuing with the second internship now. I will be submitting all the documents this month but I’m confused as to which form I should fill. The 2023 or 2024 or 2025. Or everything and submit it all together? Would really appreciate your help and response.

Thank you in advance,

Ranga

Hello Ranga,

It is simple. Please complete the Tax forms for 2024 and 2025. More details in https://prasanthragupathy.com/2024/03/tax-list-of-income-tax-declaration-forms-in-france/

Cheers,

Prasanth

PS: If my articles and answers are helpful, please leave your feedback on Trustpilot

Hey Prasanth,

I just realised that I never filed my French taxes for 2021. I had a short 6-month contract (CDD) in Cannes back then.

At the time, I honestly didn’t know I was supposed to declare it, and I never got any letters or reminders from the tax office.

Now that I’m applying for French nationality, I want to ensure everything’s clean and legal. So I messaged the tax office to ask how to fix it.

Do you think it’s a serious issue?

Best,

Abhilasha

Hello Abhilasha,

Unfortunately, 2022 income tax declaration for 2021 income cannot be corrected now. So, there is nothing that can be done about it.

I hope you have done the 2023 & 2024 income tax declarations properly. If there were any errors, they can be corrected now.

Cheers,

Prasanth

Situation:

– I moved to France in August 2021 as a student and started full-time work in February 2024 after completing my studies.

– I submitted my first tax declaration in December 2024, covering income for 2022 and 2023, via paper format.

– I received my fiscal number and online account access in March 2025, but I’m unable to declare 2024 income online.

– The tax office informed me that since my previous declarations were only recorded in March 2025:

– I won’t receive avis d’impôt for 2022/2023 before June.

– I cannot file the 2024 income online before June 2025.

– Therefore, I must submit the 2024 income tax declaration on paper (Form 2042).

Questions:

1.

I will move permanently to India in July 2025.

If I am eligible for a tax refund for 2024, but I close my French bank account before leaving,

➝ What should I do to receive the refund? Should I update a new bank like wise, revolut during declaration ?

2.

Regarding the “formulaire de déclaration de départ à l’étranger”: As per you mentioned in pre departure checklist

The form states it is for people left France in 2024.

Since I’m leaving in July 2025,

➝ Should I use this form next year to declare my 2025 income earned until May?

Thanks

Hello Varun,

In 2024 (2023 income), you submitted your income tax declaration very late. So, it’s normal that it wasn’t processed completely. Please respect the tax declaration deadlines and avoid any unnecessary complications.

1. You can either close your French bank account later or submit an IBAN from wise.

2.In 2026, submit the tax declaration for 2025 income and complete the relevant details.

Cheers,

Prasanth

Sharing my 2024 Income Tax declaration experience

I filed my income tax declaration for the first time this year. I had submitted all the documents as described in the article. However, SIP contacted me and asked for all my payslips from 2024. The same thing happened to my friend as well.

So, I’d like to share this: if you started working in the last quarter of the year, there’s a chance you may not have reached the second income tax bracket. Yet, your company might have deducted tax (PRELEVEMENT A LA SOURCE). In such cases, if you are entitled to claim a tax refund, it’s better to attach all your payslips along with your joining letter when you submit your documents, in order to avoid visiting SIP again.

Hello Jainish,

Thanks for sharing your personal experiences.

Note: Tax office can always ask for additional docs based on the individual situation. It can be payslips, bank statements, attestations, etc.

Cheers,

Prasanth

hello Prasanth,

Your article has given me relief from my recent depression. I moved to France as a student in 2023 and worked part-time in France for one month in 2024. However, I work remotely for a Sri Lankan company and receive my salary in Sri Lanka. Sometimes to a French account, but only as a friend’s bank transfer (up to 1000 euros per month). Should I delete this work as well?

Hello Yathavan,

As a non-EU student, you aren’t allowed to work remotely for an employer based outside France. It doesn’t matter how and where the salary was paid. It is not legal. More details https://prasanthragupathy.com/2024/03/work-can-a-non-eu-student-work-in-france

Cheers,

Prasanth

PS: If my articles and answers are helpful, please leave your feedback on Trustpilot

Hi Prasanth, Thank you for the detailed blog.

I came to France on end of December, 2024 as salaried PhD student and started receiving salary from month of Jan, 2025. I realise that I am already late for filing null tax returns and obtaining my French Tax ID and online accounts. Do you think i should wait till next April (2026) to file my returns offline? or can I still file my null tax returns of 2024 year (late filing)?

Regards,

S. Ravi Chandra Murthy.

Hello Ravi,

If I was in your situation, I would submit a simple tax declaration asap. But, the tax office may or may not accept your late declaration.

Cheers,

Prasanth

PS: If my articles and answers are helpful, please leave your feedback on Trustpilot