Updated on: March 16, 2025 | By: @rprasanth_kumar

Understanding the complexities of France’s tax system is key to optimizing your finances. This article serves as an introduction to the nuances of tax deductions, reductions, and credits, offering a roadmap for maximizing tax savings in France.

Good to know: For the 2025 tax declaration of your 2024 income, the total of all your tax benefits (reductions & credits) that help in reducing your income taxes cannot exceed €10,000. This limit is the same for all tax households, regardless of your marital status such as single or a couple, with or without a dependent.

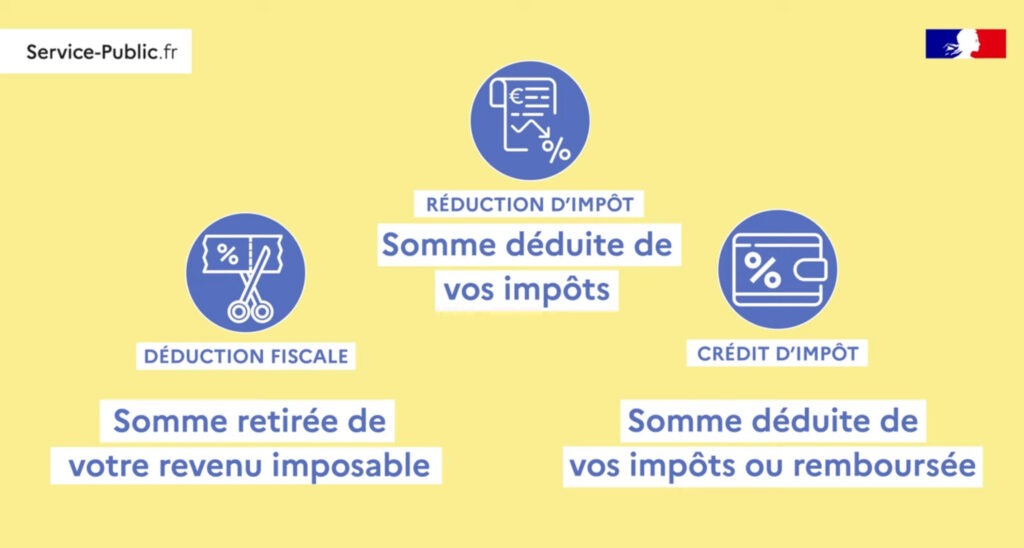

Tax Deductions vs Reductions vs Credits

Here are the basic differences between these terms and they are often misunderstood with each other. They are listed in the same order as how they are used in our income tax calculations.

Tax deductions:

- It is the amount that is removed directly from your total taxable income.

- For example: If you have an income of €40,000 and a tax deduction of €4,000. Your taxable income will then be €40,000 – €4,000 = €36,000.

- The deduction can be done from your total gross income “revenu brut global” or directly on one of your income sources like salary, real estate, etc.

Tax reductions:

- It is the amount of reduction applied to your gross income tax. So, It is only useful when you have some income tax to pay.

- For example: You have donated to a non-profit association that entitles you to a tax reduction of 500 €. If your tax is €2,000, then you will only pay €2,000 – €500 = €1,500.

- If you do not pay any income tax, you cannot benefit from the tax reductions.

- If you pay little, you can only benefit from a portion of the tax reduction.

- For example: You are eligible for a tax reduction of €700, but if you owe only €500 as tax to Impots, the remaining €200 is lost.

- So, the tax reductions are mostly useful for people in a 30% tax bracket or higher.

Tax credits:

- It is the amount subtracted from your tax amount.

- Contrary to tax reductions, the tax credits are refunded completely or partially,

- If the tax credit amount exceeds that of your income tax, or

- If you don’t have any taxable income.

- For example: You are eligible for a €500 tax credit for your childcare expenses, but if you only owe €300 as income tax, the tax authorities will refund the extra €200.

- However, the differences below €8 are not refunded.

Support This Blog!

If you’ve found my articles helpful, interesting or saving your time and you want to say thanks, a cup of coffee is very much appreciated!. It helps in running this website free for the readers.

Types of Tax Deductions

The following types of tax deductions are available in France.

- Professional expenses “Frais professionnels” (actuals or -10% standard deduction). For example: Fuel expenses, Work from home expenses, etc.

- Payments made towards your Retirement Savings Plan (PER) in France. For more details, PER – Plan Epargne Retraite: French Retirement savings account and tax reduction.

- Family support payments “pensions alimentaires” for children, payments to spouse or ex-spouse after separation, and parents or grandparents. It also includes the money transferred to dependent parents living abroad.

- Compensatory allowance to ex-spouse after divorce “prestation compensatoire“.

- Expenses towards accommodating a very aged person (above 75 years) at your home “Frais d’accueil d’une personne âgée“.

- Charges related to Historical Monuments “Monuments historiques – Charges déductibles“.

- Owner of a unfurnished rental property, you can benefit from a tax deduction if the expenses are higher than your rental income “Déficit foncier“.

Related Article,

Types of Tax Reductions

The following types of tax reductions are available in France.

- Children’s tuition fees in France “frais de scolarité“.

- Donations to associations and political parties in France.

- Investments in rental properties via Loi Pinel/Duflot and Loi Denormandie.

- Investments in French overseas territories via Loi Girardin Industrial.

- Investment in companies dedicated to financing film and audiovisual production “SOFICA“.

- Investment in small-scale enterprises “PME“.

- Investment in a complete property restoration operation in certain protected areas as per the Loi Malraux.

Related Article,

Types of Tax Credits

The following types of tax credits are available in France.

- Childcare expenses for children or grandchildren under the age of 6 outside your home, frais de garde d’enfant hors du domicile.

- Employing someone at home, directly or via a service provided by an association, company or approved organization, emploi d’un salarié à domicile.

- Home installation of charging station for electric vehicles, installation de bornes de charge.

- Modifications done to adapt housing for the loss of autonomy related to age or disability.

Related Article,

Sources & References

- Brochure pratique 2024 de l’impôt sur le revenu impots.gouv.fr

- Impôt sur le revenu: déductions, réductions et crédits d’impôt

Support This Blog!

If you’ve found my articles helpful, interesting or saving your time and you want to say thanks, a cup of coffee is very much appreciated!. It helps in running this website free for the readers.

Disclaimer

Any finance-related information shared is not professional legal, tax, or investment advice. The information provided is of an educational and general nature and is not investment advice within the meaning of Articles L. 321-1 and D. 321-1 of the French Monetary and Financial Code. Investment carries risks of loss and past performance does not guarantee future performance. For all professional advice, please consult a certified financial planner, CGP, CIF, tax consultant, etc.