Portage salarial, also known as an umbrella company, is a flexible work option for freelancers in France. This arrangement allows individuals to work independently while enjoying the benefits of traditional salaried employment through an umbrella company. This article explores the topic in detail, benefits, and disadvantages.

Thanks to Siddhant for sharing his knowledge and personal experiences about portage salarial in France.

What is Portage Salarial?

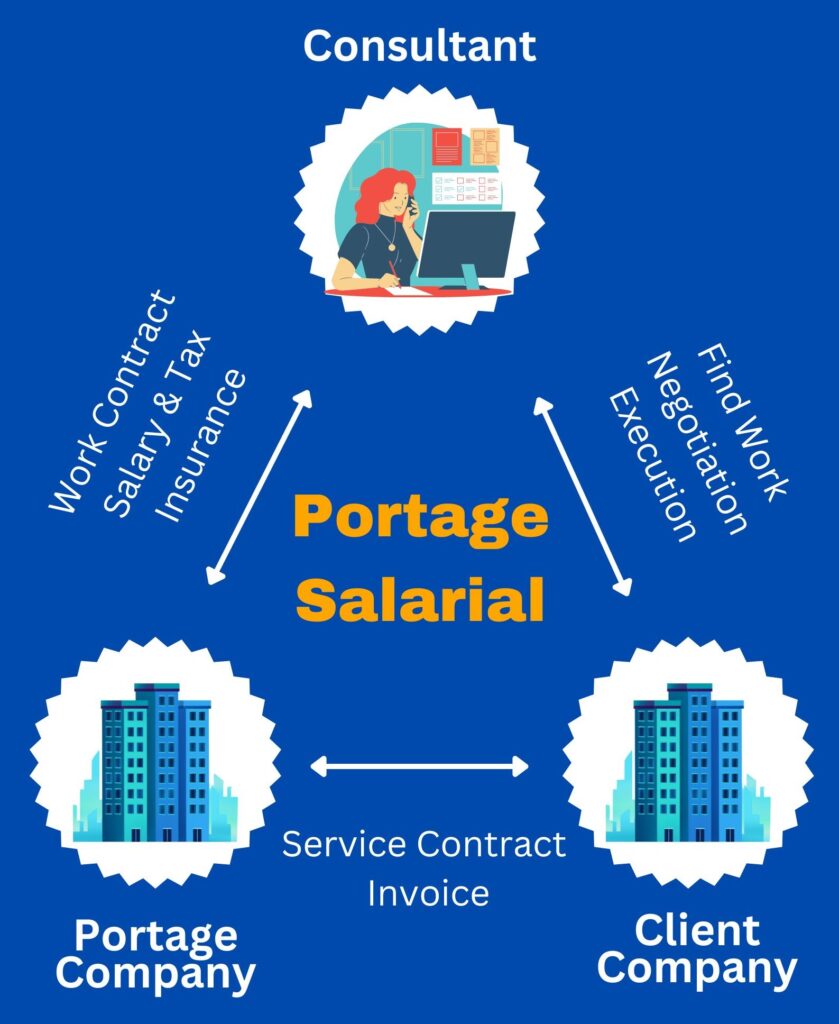

- A “portage salarial” is the French equivalent of an “Employer-on-Record” or an “Umbrella company.”

- It allows freelancers and self-employed professionals to be treated as employees of the portage company. They are known as consultants.

- According to Article L1254-2 of the French Labour Code, “a portage salarial employee must justify expertise, qualifications, and autonomy that allows him to search for his clients himself and to agree with them on the conditions of execution of his service and his cost”.

- The employee must have at least a professional qualification of Bac+2 or a significant experience of at least 3 years in the same sector of activity.

How does it work?

To set up a portage, three contracts are needed

- one between you and the portage company (employment contract – can be either CDI or CDD, full-time or part-time)

- one between the portage company and your client (service contract), and finally

- one between you and the client.

This arrangement is similar to that of a consultancy company—with the portage being the consultancy and you being the consultant working with the consultancy company for the client.

The difference is that in this case, you are free to choose the clients you want to work for and don’t answer to the portage company. The portage company is not required to provide any work to the employee.

Once you are set up, you become an employee of the portage company while still working directly with your client. The portage company will just facilitate payments of your client invoices and your payslip and will not have any managerial or performance evaluation powers over you.

Every month, the portage company must inform the employee of the following things:

- Payment made by the client company to the portage company for the work.

- Details of management fees “frais de gestion”

- Business expenses “Frais professionnels”

- Social Security and tax deductions

- Net salary

- Amount of business contribution allowance

Salary Payment

Once you are set up with a portage company, instead of invoicing your client directly, you will need to do it via the portage. Most portage companies will have a system in place that lets you create invoices in a format accepted by the French administration. Once an invoice is created and validated by the portage company, they will send it over to your client. The client then pays the portage company instead of you directly. This is the invoice amount/rate or turnover.

The portage company will first deduct their commission. Then, they will deduct the employer’s share of social security contributions (around 42%) and any professional expenses to be reimbursed to you. The amount remaining now is your gross salary.

All employee contributions and deductions then happen on this gross salary (social security, mutuelle, meal cards, etc) to give the net salary. Income tax is then deducted on the net salary.

Finally, the professional expenses deduced above are added to the amount left now, and this is the amount that is then transferred to your account.

Given that the portage company must respect the regulated minimum wage, your invoice amount to your client(s) must be high enough for your gross salary to be higher than this minimum wage after all deductions. If not, you won’t be able to work with a portage salarial and will need to take the micro-enterprise route.

This total gross minimum salary must be at least 2,517.13€ per month. This includes the basic salary, paid leave allowances, and the 5% business contribution “la prime d’apport d’affaires”.

Commission for Portage

All portage companies charge a commission for their administrative work. In most cases, this is a percentage of your invoice amount (it ranges from 5% to 15%), but some also offer a flat-rate fee. Before choosing a portage, it is recommended that you compare their commission structure.

Portage companies can also charge extra for add-on benefits, such as salary advances, culture coupons, PEE/PERCO accounts, etc

Mutuelle

As with most other employers, portage companies also offer a collective mutuelle. You have the option of choosing theirs or using your own. Most make it mandatory to have a mutuelle, meaning that to discontinue theirs, you need to prove that you are already covered by another mutuelle.

The portage company is also responsible for obligations concerning occupational medicine “la médecine du travail”.

Holidays

Portage companies are also legally obligated to offer at least 2.5 days of paid leave for every month worked.

Advantages of Portage

- You get a CDI contract (strengthens your rental application dossier a lot).

- You remain affiliated with the French Social Security – including unemployment and retirement benefits.

- You are free to choose your clients.

- You can get professional expenses reimbursed.

- You don’t have to deal with URSSAF or any of the other agencies.

- Your portage company can apply for your work permit.

- You can apply for a visa or renew your resident permits using this contract. For example: Visa or Carte de Sejour – Salarié, Travailleur temporaire, Talent Salarié Qualifié and Talent Carte bleue européenne (EU Blue card).

- You will be eligible for unemployment benefits from France Travail (formerly Pole Emploi).

Limitations of Portage

- You have to pay a commission to the portage company for its administration.

- Since the employer’s contributions will also be deducted from your invoice, you will end up getting only around 50% of what you invoice to your clients.

- Portage salarial is not possible for regulated professions such as lawyers, doctors, pharmacists, hairdressers, notaries, etc.

Siddhant’s experience with Prium Portage

I have been working at Prium Portage for over 1.5 years now. I chose them over others due to their very high Trustpilot rating, low commissions, and English support. And Touchwood, my experience with them has been mostly positive.

I have a responsive, English-speaking “advisor” who helped set up my account with them even before I landed in France. They also organise free training. I got a 20-hour French training that was very helpful. I have not heard of any other Portage company doing this.

Finally, they have a decent web portal—in English—that lets you do most of your day-to-day admin work—creating and sending invoices, submitting expenses, etc. Not having to deal with a person for regular tasks is a Godsend. Feel free to reach out to me at siddhant.sadangi@gmail.com if you want a referral.

There are over 200 Portage companies in France. You can refer to the inexhaustive checklist below to help you choose one:

- Potage commission rate

- Hidden charges

- Google and Trustpilot reviews

- Simulation of your payslip

- English support, if you do not speak French.

Other Portage Companies in France

A few other options for portage salariale companies are:

You can also find these companies by contacting:

- FEPS (Fédération des entreprises de portage salarial)

- PEPS (Syndicat des professionnels de l’emploi en portage salarial)

You can find a lot more information about portage salarial on guideduportage.com

Support This Blog!

If you’ve found my articles helpful, interesting or saving your time and you want to say thanks, a cup of coffee is very much appreciated!. It helps in running this website free for the readers.

Sources & References

- Portage salarial service-public.fr

- Principles of Portage salarial bpifrance-creation.fr

- Conditions of portage salarial: Articles L1254-1 to L1254-31 of the French labor code.

- Legal Sanctions: Articles L1255-14 to L1255-18 of the French labor code.

- Décrets portage salarial: Articles D1254-1 to R1254-5 of the French labor code.

- Consultation annuelle sur la politique sociale de l’entreprise, les conditions de travail et l’emploi: Articles L2312-26 to L2312-35 of the French labor code.

- Électorat et éligibilité portage salarial: Article L2314-21 of the French labor code.

- Convention collective de branche des salariés en portage salarial legifrance.gouv.fr

- Plafond de la sécurité sociale pour 2017 legifrance.gouv.fr

Hi Prasanth,

Thank you for posting this helpful article.

I have a question regarding the eligibility requirement for this kind of activity.

Is it possible under Passport Talent status?

Hello Viresh,

Portage salarial is a regular salaried employment. So, it is allowed under Passeport Talent.

Hello Prasanth,

Thank you so much for this article. It is indeed very informative and addressed all my questions . It provided valuable insights and was easy to understand. I really appreciate the efforts put into creating such a helpful resource. Highly recommended for anyone looking for detailed information on this topic

Hello Vijeth,

Thanks a lot for your feedback.

Hello Prasanth,

Thank you for this helpful guide.

Could you please provide me details on Micro- Entrepreneur and whom I have to approach for the registration?

I asked some of my friends and colleagues, but they don’t have the details. I hope you can help me.

Thank you in advance.

Hello Ram,

Official info about ME

https://www.economie.gouv.fr/cedef/micro-entrepreneur-auto-entrepreneur

https://entreprendre.service-public.fr/vosdroits/F37398

https://entreprendre.service-public.fr/vosdroits/F23961

To create ME:

https://www.inpi.fr/creer-en-tant-que-micro-entrepreneur

https://www.autoentrepreneur.urssaf.fr/portail/accueil/creer-mon-auto-entreprise.html

So far, I have not yet started advising people about Business creation topics because it requires a lot more time in understanding the specific situation, type of business activity, possible visa/resident permits, etc.

If required, You can get help from Professionals (expert comptable) for a small fee. A few examples below.

– https://www.entreprises.cci-paris-idf.fr/web/formalites/creation-entreprise-individuelle?

– https://www.legalplace.fr/contrats/creation-micro-entreprise/?

– https://qonto.com/fr/creation/auto-entrepreneur?

– https://www.portail-autoentrepreneur.fr/statut-auto-entrepreneur