There are multiple types of stock exchange orders to buy or sell stocks in France and the major French stock exchange is Euronext Paris. Each order type corresponds to the choice of the investor. These are in line with the standards practiced globally.

Some investors would like to buy/sell a stock immediately after the morning stock market opening. Some would like to pass an order at a predefined price, some prefer the speed of execution, book profits or sell at a loss, some would like to do it based on the market trend, etc. Each type of order gives you control over how and when your trades happen.

Check that your stock order is complete

If your order does not contain all the necessary information, it cannot be executed. It is therefore important to ensure that you are transmitting the following information to your financial intermediary (broker):

- nature of the transaction: Buy or Sell

- name of the company or the ISIN code

- nature of the security (share, ETF, bonds, etc.)

- amount of securities you wish to exchange

- type of exchange order and, if applicable, its price limit,

- duration of the order.

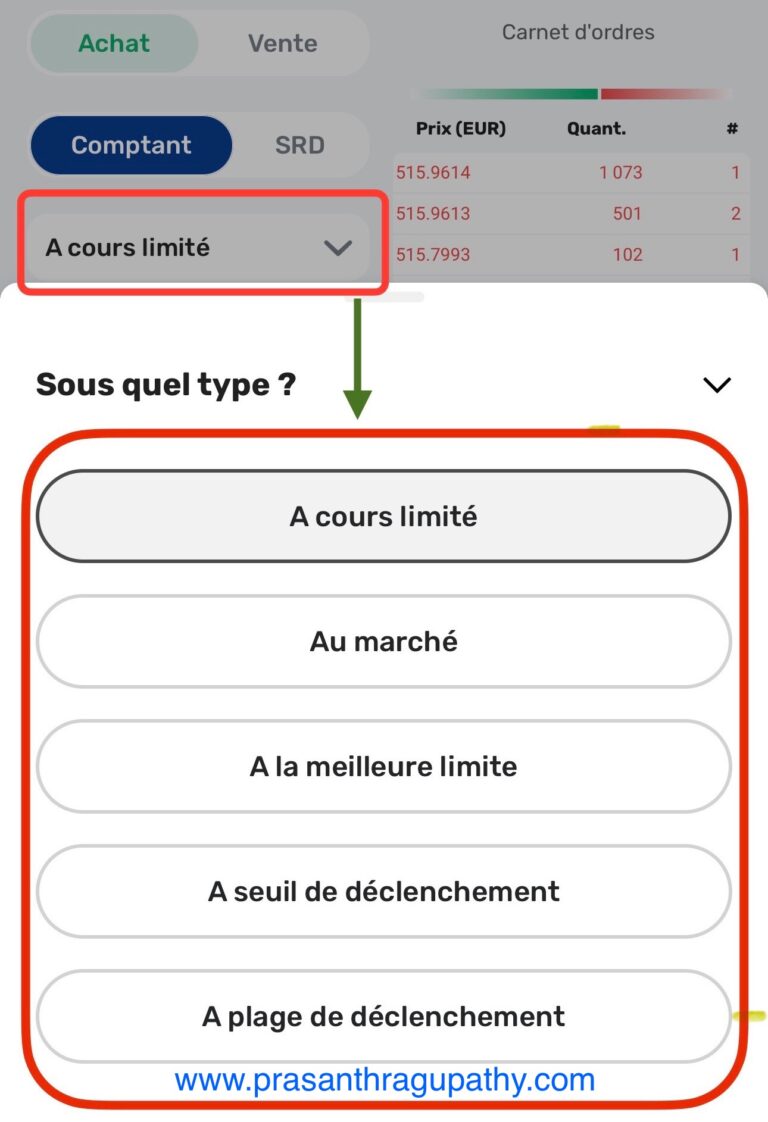

Common Types of Stock exchange Orders

1. Market Order (Ordre au marché): A market order allows you to buy or sell a specified quantity of securities without setting a price limit.

- The primary advantage is that it takes priority over limit orders, ensuring immediate execution if there are enough securities available.

- However, the downside is that the investor has no control over the execution price. Therefore, using this type of order on illiquid assets is not recommended, as there is a significant risk of the order being executed at a price far from the last quoted price.

- This order buys or sells immediately at the best available price. It’s fast but doesn’t guarantee the exact price.

2. Limit Order (Ordre à cours limité): A limit order allows the client to set a maximum purchase price or a minimum selling price.

- The advantage is that the execution price is controlled, but there’s a risk that the order might not be executed if the market price remains above (for buy orders) or below (for sell orders) the specified limit.

- When the limit is reached, the order may be partially or not executed at all if liquidity is insufficient.

3. Best Limit Order (Ordre à la meilleure limite): A best limit order is placed on the market without specifying a price. The market automatically adjusts the order to match the best available counterparty price during the session or just before the opening or closing price fixing.

- At Market Opening: The order is fully executed at the opening price if liquidity is sufficient. Otherwise, it becomes a limit order at the opening price.

- During the Session: The order is executed at the best available price if liquidity is sufficient. If not, it turns into a limit order at the price of the first trade for the remaining quantity.

4. Stop Order (Ordre à seuil de déclenchement): A stop order triggers a market order once a predetermined price, known as the “stop price,” is reached.

- For Buy Orders: The stop price must be higher than the last traded price.

- For Sell Orders: The stop price must be lower than the last traded price.

- Once triggered, a market order is sent to the market. Stop orders are typically used when anticipating a trend reversal.

- However, in cases where multiple stop orders are triggered in quick succession or when the market experiences significant fluctuations, the investor risks the order being executed at a price far from the stop level.

5. Stop-Limit Order (Ordre à plage de déclenchement): A stop-limit order combines the features of a stop order and a limit order. It allows you to set both a stop price and a limit price.

- For Buy Orders: The stop price must be higher than the last traded price, and the limit price must be above the stop price.

- For Sell Orders: The stop price must be lower than the last traded price, and the limit price must be below the stop price.

- Once the stop price is reached, a limit order is placed. This order type is also used when anticipating a trend reversal.

- However, if the market experiences significant fluctuations, there’s a risk that the order might not be executed.

Other Types of Orders

- Good-Till-Canceled (GTC) Order (Ordre valable jusqu’à révocation): This type of order stays active until you cancel it. It doesn’t expire at the end of the day.

- Day Order (Ordre valable jusqu’à la fin de la séance): This order is only good for the current trading day. If it’s not filled by the end of the day, it gets canceled automatically.

- Good Till Date (GTD) Order (Ordre valable jusqu’à une date donnée): This order stays active until a specific date. If it’s not filled by then, it’s canceled.

- At-the-Open Order (Ordre à l’ouverture): This order is executed right at the start of the trading day, at the opening price.

- At-the-Close Order (Ordre à la clôture): This order is executed right at the end of the trading day, at the closing price.

These orders help you control how and when your trades happen, depending on your goals and the market situation.

Support This Blog!

If you’ve found my articles helpful, interesting or saving your time and you want to say thanks, a cup of coffee is very much appreciated!. It helps in running this website free for the readers.

Disclaimer

Any finance-related information shared is not professional legal, tax, or investment advice. The information provided is of an educational and general nature and is not investment advice within the meaning of Articles L. 321-1 and D. 321-1 of the French Monetary and Financial Code. Investment carries risks of loss and past performance does not guarantee future performance. You should consult a financial advisor for any professional advice.