Sending money internationally can be essential for various reasons, from supporting family abroad to conducting business. With numerous transfer services available, each offering different features and costs, it’s important to understand the steps involved and how to choose the most efficient and cost-effective method.

This article outlines the general process, fees, tax applicable and provides tips to help you navigate international money transfer services successfully. These transfer services are a cheaper alternative to regular bank-to-bank transactions.

Good to know: Don’t focus only on the forex rate because the transfer companies play around with fees & exchange rates. For comparisons, always use the final amount that will reach the recipient’s bank account.

Good to know: For large transactions, direct bank to bank transfers might be a good option too sometimes. Check with your bank before doing the money transfer.

How To Send Money Internationally?

Sending money abroad via money transfer service can be straightforward if you follow these general steps, which most transfer services outline clearly.

- Register or Sign In: First, choose the most suitable international money transfer app for your needs. Create an account and verify your identity with a driver’s license, passport, or other government-issued ID.

- Provide the Recipient’s Details: Enter the recipient’s name and banking details. If the recipient will pick up the money, specify the location. Ensure the recipient’s name matches their government ID exactly.

- Choose the Amount To Send: Decide how much money to send and in which currency the recipient will receive it. Use a currency converter calculator if needed to determine the exchange rate.

- Pay for Your Transfer: You can fund the transfer using a credit card, debit card, or direct bank transfer. Bank transfers are typically the least expensive option, while credit card payments may incur additional fees.

- Track Your Transfer: Most transfer services provide an estimated delivery date and time. You can usually track the status of your transfer via the app.

Commonly Used Transfer Services

There are many international money transfer services available in the market. Some examples are listed below.

- XE.com, Get a €25 gift card for sending €1000 or more using the promo code XEREF-QR6B6APC.

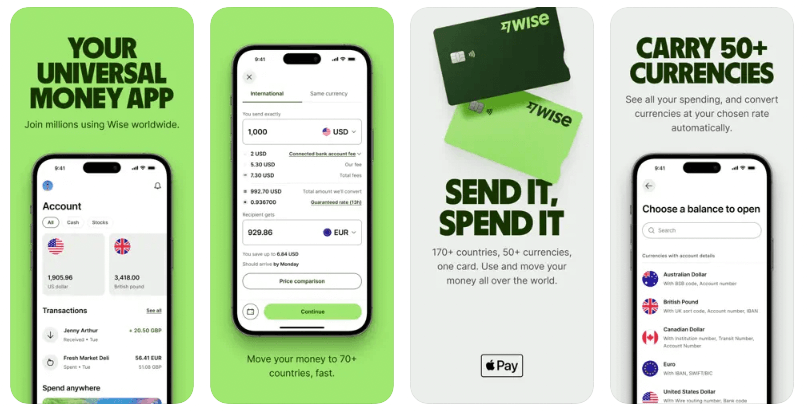

- Wise, use the referral link to get one free transfer up to €500.

- Remitly, use the referral link to get €10 off on your first money transfer of €100 or more.

- Skrill, use the referral link to get €15 off from your first international transfer of money transfer of €150 or more.

- Revolut, open a free bank account using the referral link and join over 40 million users who love Revolut.

- Instarem

- Western Union

- Currencyfair, etc.

You can use monito.com to compare and know the best money transfer option on any given day. New options are introduced regularly but it is better to stick with established ones because the safety of our hard earned money is more important than a few bucks saved on promise of forex rate, lower fees, etc.

Personally, I use XE.com (1st option) and Wise for most of my transfers between India and France.

Example: Transfer from India to France

You can do international money transfers using direct bank-to-bank transactions or via the money transfer services listed above. Due to the introduction of TCS in India, some transfer services might not be available or have some limitations. A PAN card might be required too.

Tax is not applicable in France, if the transfer is from your own account. If its part of your inheritance from your parents/relatives, an inheritance tax might be applicable.

Using Resident Bank Account

As per the Liberalised Remittance Scheme (LRS) regulations, you can transfer funds from India to overseas up to USD 250,000 per financial Year (April-March). This limit can be used for expenses towards,

- Private visits to any country (except Nepal and Bhutan)

- Gift or donation

- Going abroad for employment

- Emigration

- Maintenance of close relatives abroad

- Travel for business, or attending a conference or specialized training or for meeting expenses for meeting medical expenses, or check-up abroad, or for accompanying as attendant to a patient going abroad for medical treatment/ check-up

- Expenses in connection with medical treatment abroad

- Studies abroad

Tax Collected at Source (TCS) is applicable for international transfers from resident Indian bank accounts. The TCS paid can be used to offset your tax liability in India at the time of submitting your income tax declaration in India.

| Type of Transfer | TCS rate (from 1st October 2023) |

| Foreign education, financed by loan from financial institution | Nil up to ₹7 lakhs |

| 0.5% above ₹7 lakhs | |

| Foreign Medical treatment/ education (other than financed by loan) | Nil up to ₹7 lakhs |

| 5% above ₹7 lakhs | |

| Purchase of an foreign tour package | 5% up to ₹7 lakhs |

| 20% above ₹7 lakhs | |

| Other purposes | Nil up to ₹7 lakhs |

| 20% above ₹7 lakhs |

Note: NRIs cannot hold resident bank accounts in India.

Using Non-Resident Ordinary (NRO) Bank Account

- Tax Collected at Source (TCS) is not applicable for NRO bank accounts..

- No limit on repatriation of current income. For example: income from rent, interest, dividends, professional fees, and pension).

- Repatriation of capital income up to a maximum of USD 1 million per financial Year (April-March) is allowed. For example: income from Fixed Deposit (FD), sale of property, redemption of mutual funds, shares, etc.

- NRIs can transfer upto USD 1 million from their NRO account to their NRE account per financial Year (April-March).

Using Non-Resident External (NRE) or FCNR Bank Account

- Tax Collected at Source (TCS) is not applicable for NRE and FCNR accounts..

- No limit on the amount of funds you can transfer from your NRE or FCNR accounts.

Example: Transfer from France to India

Inward remittances can be done by Non-Resident Indians (NRIs), Overseas Citizens of India (OCIs), or foreign citizens to bank accounts in India. They can be made for various purposes, including family maintenance, education, medical expenses, and investments.

There is no maximum limit on the amount transfered from France to India, as long as it’s completey legal transfer. No tax applicable in France on the money transfers to India. However, the French banks can ask about the source of funds as part of their KYC process to prevent money laundering, etc. If you do not provide the necessary information, the bank has the right to close your bank account.

India’s Foreign Exchange Management Act (FEMA), says that when you send money to a family member in India as a gift or for family support, then the money received in India is tax free. To be considered a family member in India, the recipient must be,

- (a) Your Spouse;

- (b) Your Brother or sister;

- (c) Brother or sister of your spouse;

- (d) Brother or sister of either of your parents;

- (e) Any lineal ascendant or descendent of yours;

- (f) Any lineal ascendant or descendent of your spouse;

- (g) Spouse of the persons referred to in (b) to (f).

If money is sent to anyone else not mentioned in the above list, they are considered as non-relatives and the amount will be taxed as their “income from other sources as per section 56” if it is over ₹50,000 in a financial year.

International Money Transfer Tips

When you are planning to transfer money internationally, consider several factors to minimize fees and ensure efficiency. Fees can vary based on the transfer method, speed, and destination, so it’s important to compare options for each new transfer.

- Check your bank account’s international transfer limits. For example: If there is a limit of 5000€ and you initiate a transfer of 7000€, your bank will reject the transfer.

- Money Transfer companies play around with the fees and forex rates. So, select the one that offers the lowest transfer fees and best exchange rate for the transfer amount.

- It is better to choose the service which sends the highest value to the recipient’s account.

- Use comparison websites like https://www.monito.com/ to evaluate different services. Some services may be better for small transfers, while others might be more cost-effective for larger amounts.

- Avoid using a credit/debit card to pay for your transfer unless absolutely necessary, as it is usually the most expensive option.

- Ensure the delivery timeline meets your recipient’s needs. Some transfers are instant, while others may take several days.

- Verify that your recipient receives the money. Ensure accuracy when entering contact or bank information to avoid sending money to a wrong account.

- Don’t keep looking for the newest money transfer companies. Your money is more important than their offers.

Conclusion

Sending money internationally can be expensive, but numerous services with varying pricing and features are available. Compare options based on the destination and required features. Check exchange rates and fees to find the most economical method. Avoid credit card payments for transfers whenever possible, as they are likely to incur the highest costs.

Sources & References 📕

- Reserve Bank of India (RBI): FAQs on Liberalised Remittance Scheme

- Inheritance Tax in France: Taxable property and principal exemptions

- SBI: Remittance from India – International Banking

- Reserve Bank of India (RBI): List of remittance purpose codes on RBI’s website.

- Income Tax India: FAQs on Gifts received by an individual or HUF

Support This Blog!

If you’ve found my articles helpful, interesting or saving your time and you want to say thanks, a cup of coffee is very much appreciated!. It helps in running this website free for the readers.

DISCLAIMER

This post might contains affiliate links. If you click and make a purchase or open an account, I may earn a commission—at no extra cost to you. It helps in running this website.

Any finance-related information shared is not professional legal, tax, or investment advice. The information provided is of an educational and general nature and is not investment advice within the meaning of Articles L. 321-1 and D. 321-1 of the French Monetary and Financial Code. Investment carries risks of loss and past performance does not guarantee future performance. Please consult a financial advisor for any professional advice.

Very informative and well explained. Helpful guidance an easy to understand how the transaction can be done. Thank you for writing this.

Hello Aswathy,

Thanks for your feedback. Feel free to use the referral links, so it will help in maintaining this website with the latest information.

Dear Prasanth,

Thanks for your nice article/blog…It’s quite informative…I generally prefer bank-to-bank transfer from India to France and vice-versa, for safety and security reasons…After reading your article, I just went to check yesterday “WISE” to transfer 10 lac from my Indian bank account (NRE) to my France bank account and found that their charges are quite high as compared to direct bank transfer…As you know, Indian bank websites clearly explain the total transfer charges in this regard nowadays, but varies from bank to bank…So, I am rather confused and is interested to know your experience is such a comparative study if you have done already as you transfer regularly…Regards…Amit DUTTA

Hello Amit,

The money transfer services like XE, Wise, etc clearly show the fees and forex rates before doing the transfer. If the direct bank to bank transfer is cheaper, you can do that too. But, fees will be charged by both the origin bank and recipient bank.

I have mentioned both in my article.

What matters is the final amount received in the beneficiary account. If you are sending 10 lakhs INR, use the option which sends the maximum amount after deducting the fees, forex, etc.

Hi Prasanth,

As always, a very useful article. I just had another quick question – Is there a limit on the amount of money that we transfer from France to India? If so, where can I find some information on this? Thanks again!

Hello Karthik,

No, there is no maximum limit on the money transfered to India.

But your French bank will probably ask the source of funds and the reasons for the transfer as part of the KYC process. If a proper explanation is not provided, the bank can even close your account.