Published on: October 31, 2024 | By: @rprasanth_kumar

If you’re holding cash and looking for a way to put it to work, or if you want to reduce your portfolio’s volatility without losing the tax benefits of a Plan d’Épargne en Actions (PEA), Amundi’s offering could be just what you need. The Amundi PEA Euro Court Terme UCITS ETF is a unique, low-risk investment solution tailored to PEA holders seeking stable, short-term growth.

Personally, I use this ETF in my PEA Account to hold the cash awaiting to be invested in other stocks and ETFs. For more details, Plan d’épargne en actions (PEA): Is it the best investment option in France?.

What is Amundi PEA Euro Short-Term UCITS ETF?

The Amundi PEA Euro Court Terme UCITS ETF is a low-risk exchange-traded fund designed to help investors grow their cash within the PEA framework.

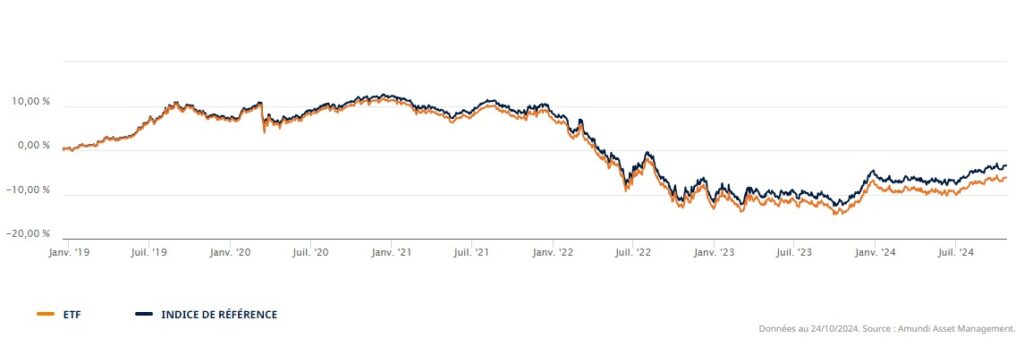

- This ETF tracks the Solactive ESTR Overnight Total Return Index SOESTRON, which mirrors the Euro Short-Term Rate (€STR).

- This index represents short-term interbank rates used by banks across the eurozone for daily transactions, offering an accurate benchmark of eurozone liquidity conditions.

- With the Amundi PEA Euro Short-Term ETF, your cash benefits from the stability of this rate, which currently hovers around 3.1%* – a rare offering for PEA-eligible investments that is both stable and tax-optimized.

Key Details of the ETF

Data | Description |

| ISIN | FR0013346681 |

| Google Finance Code | EPA:OBLI |

| Stock Exchange listing | Euronext Paris |

| Reference Index | Solactive ESTR Overnight Total Return Index, SOESTRON |

| Investment Focus | Bonds, EUR, Europe, Government Bonds, All Maturities |

| Fund Size | EUR 35 M |

| Total Expense Ratio (TER) | 0.25% p.a. |

| ETF Replication Method | Synthetic (Unfunded Swap) |

| Legal Structure | ETF |

| UCITS | Yes |

| Eligibility for PEA | Yes |

| Fund Currency | EUR |

| Currency Risk | Not hedged against currency risk |

| Inception/Trading Start Date | December 17, 2018 |

| Distribution | Accumulation |

| Distribution Frequency | Not Applicable |

| Fund Domicile | France |

| Promoter | Amundi ETF |

Why Choose This ETF?

This ETF offers unique benefits to investors aiming for short-term security and growth:

- Stable Returns: With a rate that tracks the €STR, your funds work at a stable, short-term rate.

- Tax-Efficient: As a PEA-eligible product, this ETF lets you earn returns while retaining the tax advantages of your PEA.

- Low-Risk Profile: Compared to more volatile options, this ETF is designed to protect your capital in the short term.

- It can be used for the debt allocation in the PEA portfolio or simply store the cash waiting to be invested in other stocks and ETFs.

Unlike riskier assets, this ETF is ideal for conservative investors who prioritize liquidity and stability over higher-risk investments.

Is This ETF Right for You?

The Amundi PEA Euro Short-Term UCITS ETF is an excellent choice for investors with liquid assets who want to earn a competitive return without increasing risk.

- It’s also a simple, effective option for investors seeking to maximize short-term returns within the PEA’s tax-advantaged framework.

- With a 0.25% management fee, this ETF provides cost-effective access to a stable short-term rate, allowing every euro to work efficiently while staying aligned with your financial goals.

Support This Blog!

If you’ve found my articles helpful, interesting or saving your time and you want to say thanks, a cup of coffee is very much appreciated!. It helps in running this website free for the readers.

Disclaimer

Any finance-related information shared is not professional legal, tax, or investment advice. The information provided is of an educational and general nature and is not investment advice within the meaning of Articles L. 321-1 and D. 321-1 of the French Monetary and Financial Code. Investment carries risks of loss and past performance does not guarantee future performance. Please consult a financial advisor for any professional advice.