Published on: November 21, 2024 | By: @rprasanth_kumar

The Crypto Fear & Greed Index is a widely used tool in the cryptocurrency market. It captures investor sentiment, measuring the levels of fear or greed among market participants. By monitoring these emotions, the index helps investors make more informed decisions and avoid choices driven by panic, hype, FOMO, etc. It is someway similar to the VIX index (volatility) used for stocks.

What Is the Crypto Fear & Greed Index?

The Crypto Fear & Greed Index provides a score from 0 to 100:

- 0 to 24: Extreme Fear – Sentiment is very fearful, and prices may be crashing.

- 25 to 49: Fear – Sentiment is cautious, with possible investor uncertainty.

- 50 to 74: Greed – Sentiment is optimistic, and prices may be rising.

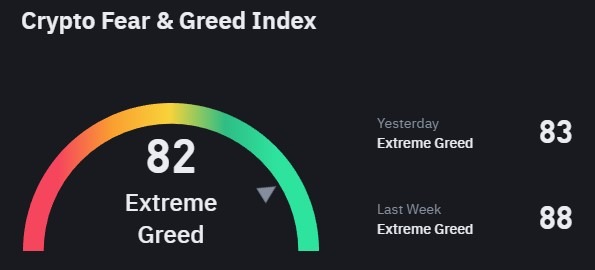

- 75 to 100: Extreme Greed – Sentiment is very bullish, and the market might be overbought.

How the Crypto Fear & Greed Index is calculated?

The index aggregates data from various sources to create a single score:

- Volatility (25%): Increased volatility suggests fear, while stability signals greed.

- Market Momentum/Volume (25%): High buying volume reflects greed, whereas low volume indicates fear.

- Social Media (15%): Trends on social platforms, such as X (formerly Twitter), highlight levels of excitement or concern.

- Surveys (15%): Periodic surveys of investors gauge overall market sentiment.

- Dominance (10%): Bitcoin dominance often shows a preference for safer assets (fear) or altcoins (greed).

- Google Trends (10%): Higher search volume for crypto-related terms often reflects shifting sentiment.

Note: The exact Index values might be slightly different between various providers but the overall trends will be the same.

Why the Crypto Fear & Greed Index Matters?

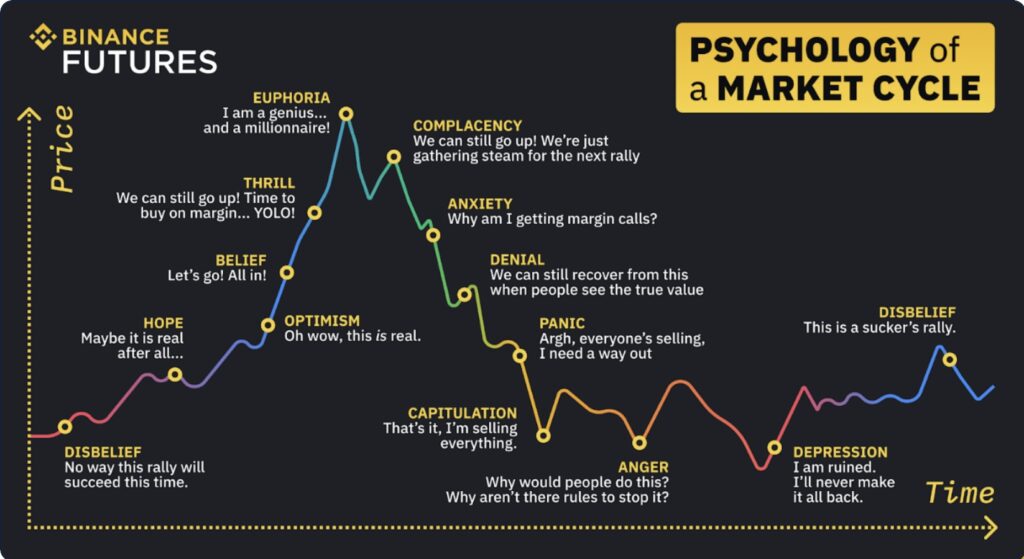

The Crypto Fear & Greed Index helps investors avoid common pitfalls by revealing the market’s emotional state. Investors are often swayed by two main emotions: fear, which can lead to sell-offs, and greed, which can result in buying frenzies. Recognizing these patterns can help traders decide when to buy, hold, or sell their crypto assets.

Practical Examples of the Crypto Fear & Greed Index

Example 1: Extreme Fear in a Bear Market

Suppose the index indicates “Extreme Fear” with a score of 15. This might occur during a market downturn or after negative news, like regulatory actions or a major exchange failure.

- Scenario: In December 2022, Bitcoin dropped from over $60,000 to around $15,000, pushing the index into extreme fear territory.

- Investor Reaction: Many investors panicked, selling assets to avoid further losses.

- Opportunity: Long-term investors recognized this as a buying opportunity, as prices often rebound after extreme fear.

Example 2: Extreme Greed in a Bull Market

Imagine the index shows “Extreme Greed” with a score of 85 during a strong market rally.

- Scenario: On 21st November 2024, Bitcoin reached a new all-time high (ATH) of around $98,000, driving the index to extreme greed.

- Investor Reaction: Many investors joined the hype, expecting prices to continue rising.

- Risk: Extreme greed can signal an overheated market, often preceding a correction or price drop. But the prices can keep rising too.

How to use the Crypto Fear & Greed Index?

- Buy During Fear, Sell During Greed: Some traders take a contrarian approach, buying during periods of fear and selling during times of greed.

- Market Timing: When the index shifts from extreme greed to fear, it can serve as a signal for traders to pause or rethink their investments.

- Risk Management: During high greed periods, traders may tighten risk management strategies, such as setting stop-loss orders, to prepare for potential corrections.

Limitations of the Crypto Fear & Greed Index

While useful, the index has some limitations:

- Lagging Indicator: As the index uses historical data, it may not always reflect real-time events.

- Not a Standalone Tool: It should be used alongside other analytical tools, as it only captures sentiment, not fundamental analysis.

- High Volatility: Crypto markets are volatile, and sentiment can change rapidly, making the index less reliable for short-term trades.

Support This Blog!

If you’ve found my articles helpful, interesting or saving your time and you want to say thanks, a cup of coffee is very much appreciated!. It helps in running this website free for the readers.

Sources & References 📕

DISCLAIMER

Any finance-related information shared is not professional legal, tax, or investment advice. The information provided is of an educational and general nature and is not investment advice within the meaning of Articles L. 321-1 and D. 321-1 of the French Monetary and Financial Code. Investment carries risks of loss including the capital invested. Past performance does not guarantee future returns. Please consult a financial advisor for any professional advice.