Published on: March 11, 2025 | Article No: 312 | By: @rprasanth_kumar

Community Question: Credit Rating in France

✅ Hello, Do you know about credit check document in France?, if so, please let me know how can I get it. Thank you for your help.

✅ Hi Prasanth, This is ZYX from Lyon. I need your advise, as I am applying for Home Loan in India and Bank need CIBIL report from my side (France). Please help if you have any input on this. Thanks in advance

My Answers

Unfortunately, France does not have personal credit score system like in the USA or the CIBIL score system in India, where credit scores are assigned by various agencies based on our borrowing and repayment history. Instead, creditworthiness is assessed differently in France, often relying on banking history, income stability, and debt records.

However, you can still access various financial reports from official institutions to check your credit standing or provide proof of financial reliability when needed. These reports help assess your financial situation based on outstanding debts, payment incidents, and banking history. Here’s how and where you can obtain them:

Banque de France: Credit Incident Records

✅ If you want to see if you’re listed for any unpaid debts, you can request information from the Fichier des Incidents de remboursement des Crédits aux Particuliers (FICP).

✅ To check your banking history (e.g., bounced checks, banking bans), you can refer to the Fichier Central des Chèques (FCC).

✅ You can request these records online or in person at a Banque de France office with your ID. Visit the Banque de France portal accueil.banque-france.fr. An account must be created and you can use FranceConnect for it.

✅ Follow the detailed step-by-step procedure explained below and the document will be available in 1-2 working days.

✅ These official documents will be issued only in French. So, you must translate them, if the requirement is from a non-Francophone country such as Australia, India, UK, etc. A related article Traducteur Assermenté: List of official translators in France.

Local Bank: Account Statements & Creditworthiness Certificate

✅ If you need proof of your financial health, your bank may provide a certificate of creditworthiness (attestation bancaire), summarizing your financial status and history.

✅ Contact your French Bank Account counselor and request for the attestation by explaining about the request for a Credit Score certificate.

✅ The attestation is usually in French but you can request for an English version (no obligation for the bank). If it is issued in French, please translate it as explained earlier.

✅ I have seen many examples of people following this process and obtaining loans in India, etc.

Support This Blog!

If you’ve found my articles helpful and you want to say thanks, a cup of coffee or two is very much appreciated!. Please help keep it going!

Procedure to obtain FICP and FCC documents

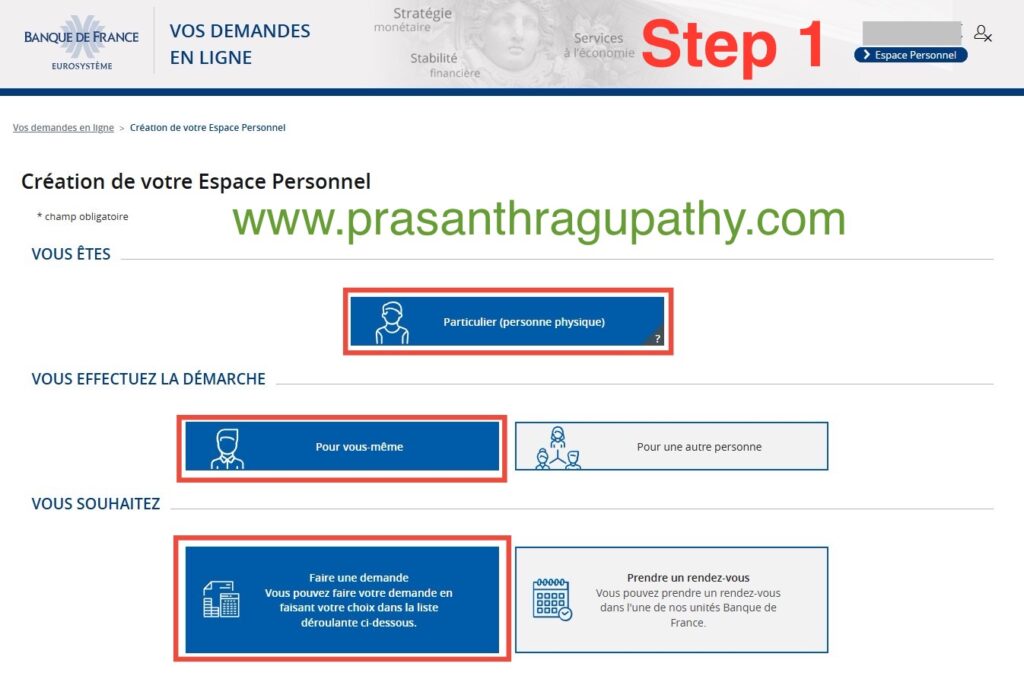

Step 1: Login to Banque de France website via accueil.banque-france.fr and start the request for FICP and FCC documents

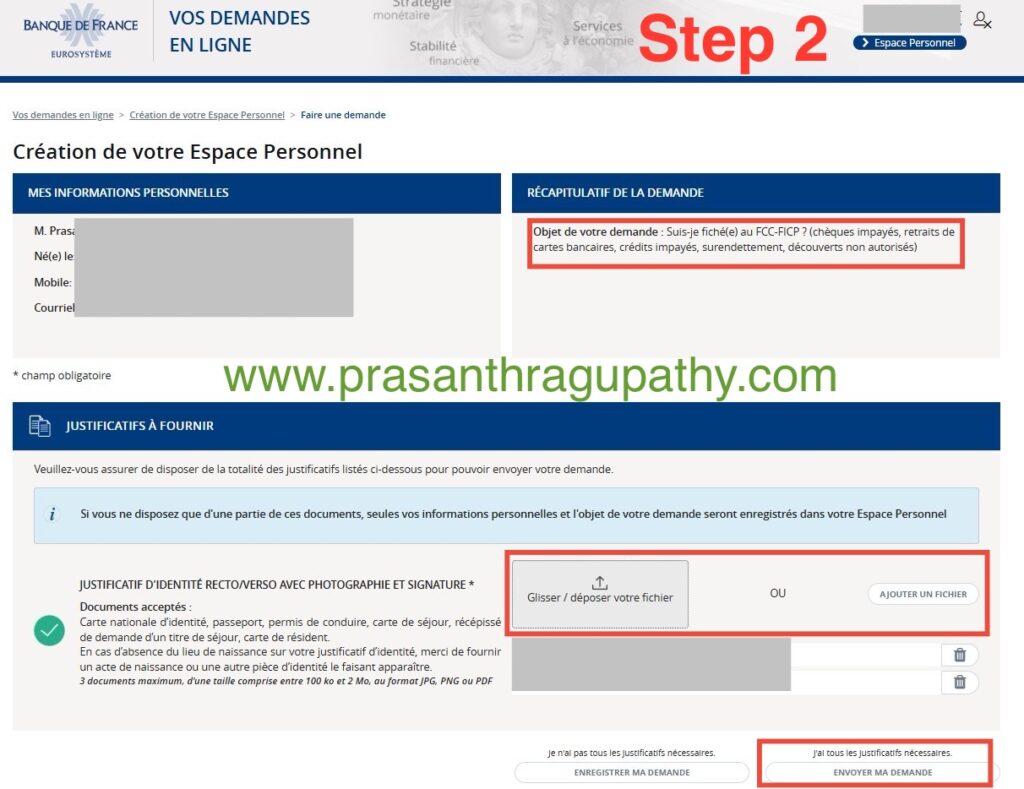

Step 2: Upload Identity Proof

✅ Select the subject of request and upload an identity document such as Passport, National ID Card, residence permit, etc.

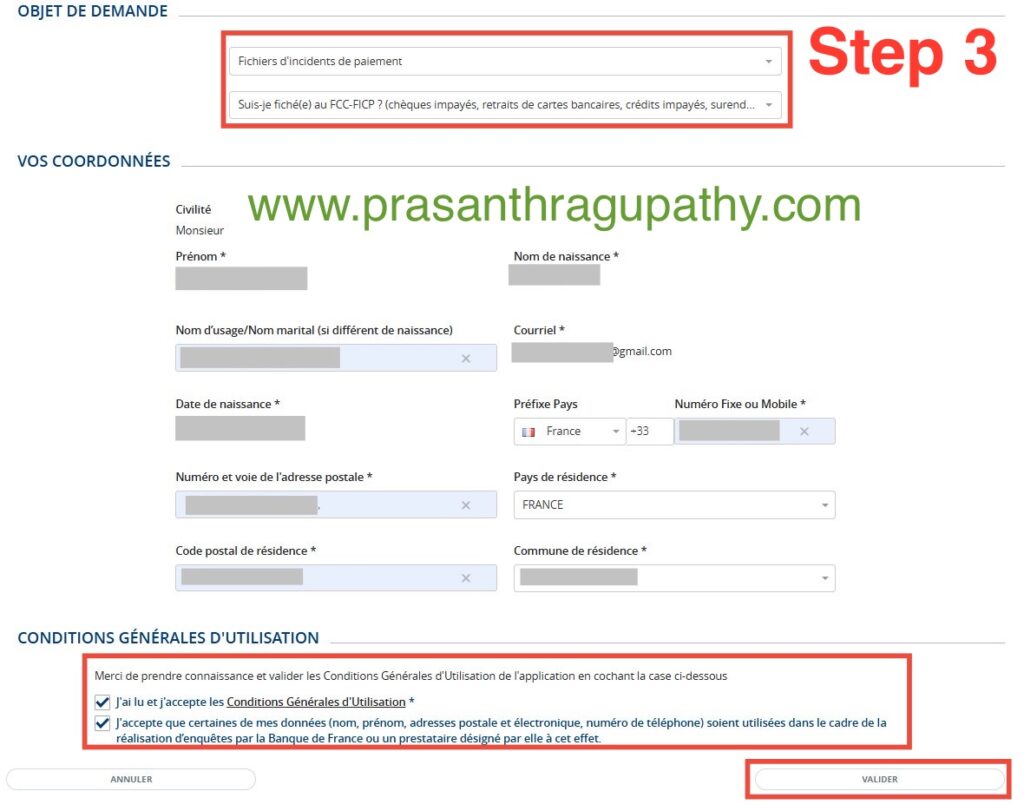

Step 3: Confirm Request and Submit

✅ Verify the request, personal information, accept the conditions and submit the application.

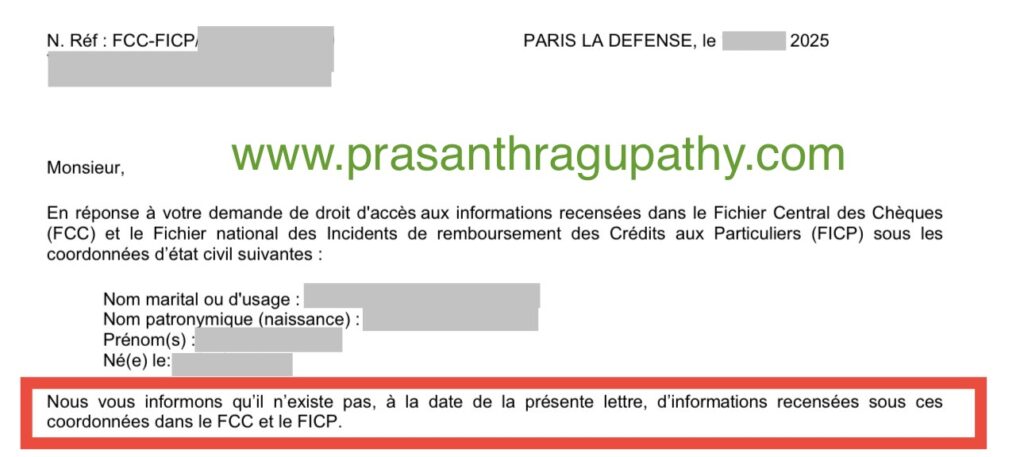

Step 4: Download FICP & FCC document

✅ The attestation from Banque de France will be available to be downloaded for 15 days and then deleted. So, keep an eye on your email notifications.

✅ In the following example, the FICP & FCC records clearly show that the applicant does not have his/her name listed in the official database (reported by banks) for any unpaid debt, bounced cheques, etc.

DISCLAIMER

Any finance-related information shared is not professional legal, tax, or investment advice. The information provided is of an educational and general nature and is not investment advice within the meaning of Articles L. 321-1 and D. 321-1 of the French Monetary and Financial Code. Investment carries risks of loss and past performance does not guarantee future performance. Please consult a financial advisor for any professional advice.