Published on: March 21, 2025 | Article No: 317 | By: @rprasanth_kumar

You may be eligible for an income tax reduction in France, if your child is enrolled in school (middle school, high school, or higher education). The child can be a student in a public or private institution, whether located in France or abroad.

French Keywords: Frais de scolarité, enfants, and réduction d’impôt.

Eligibility Criteria for Tax Reduction

When your dependent child is pursuing secondary or higher education as of December 31 of the taxation year (For example: December 31, 2024 for income earned in 2024), you may receive an income tax reduction.

Your child must:

✅ Be financially dependent on you or attached to your income tax household if they are of legal age.

✅ Be enrolled in a secondary school (middle or high school) or higher education institution during the tax year.

✅ Not have any employment contract or receive a salary (any scholarships and mandatory internship allowances are allowed).

Important Notes

- The education must be pursued collectively and on a full-time basis in an institution.

- Children no longer part of your household, as of December 31st of the tax year are not eligible for the tax reduction, even if they are still studying or receiving financial support (pension alimentaire) from you.

- Children who turn 18 during the tax year are only eligible for the reduction if they remain attached to your tax household.

Tax Reduction Amount

The tax reduction amount per child is:

✅ €61 for middle school (études secondaires du premier cycle – collège).

✅ €153 for high school (études secondaires du second cycle – lycée).

✅ €183 for higher education

Note that in the case of children living in an alternate residence or shared custody, the amount of tax reduction is divided by two between the parents.

Example Calculation of Tax Reduction

Let us use an example situation of a family with three dependent children:

✅ 1 high school student = €153

✅ 1 middle school student in full custody = €61

✅ 1 university student attached to the household = €183

Total income tax reduction possible = €397 (153 + 61 + 183).

How to declare the Tax Reduction?

To receive the income tax reduction, you must indicate the number of children concerned on your online or paper tax return form 2042 RICI. The concerned section is Nombre d’enfants à charge poursuivant leurs études.

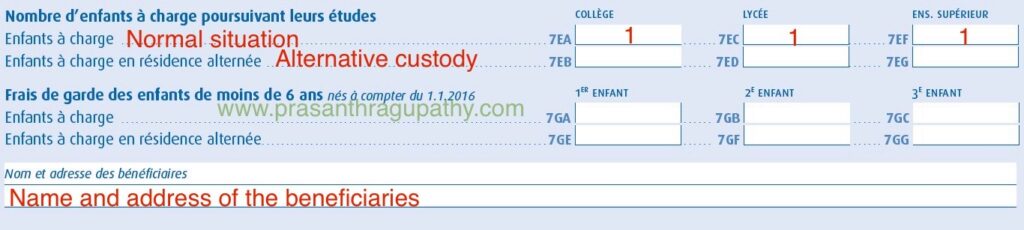

Reusing the above example of a family with three children, the entries in 2042 RICIC income tax declaration form will be,

Source: Impots.gouv.fr

Support This Blog!

If you’ve found my articles helpful and you want to say thanks, a cup of coffee or two is very much appreciated!. Please help keep it going!

DISCLAIMER

Any finance-related information shared is not professional legal, tax, or investment advice. The information provided is of an educational and general nature and is not investment advice within the meaning of Articles L. 321-1 and D. 321-1 of the French Monetary and Financial Code. Investment carries risks of loss and past performance does not guarantee future performance. Please consult a financial advisor for any professional advice.

Nice Article Prasanth.

Thanks for always sharing useful information.

Can you also share information on below topic if possible?

I.e. I have IBKR account and bought US stocks. How and where do we declare Capital gain from it etc.

Thanks once again .

Hello,

Declare Capital gains from foreign stocks is a long process involving multiple steps. It is not practical to explain it via a text article.

I have reserved it for a step-by-step video tutorial, but not anytime soon.

Cheers,

Prasanth

PS: If my articles and answers are helpful, please leave your feedback on Trustpilot

Okie Sure. will wait for that.