Published on: July 24, 2024 | By: @rprasanth_kumar

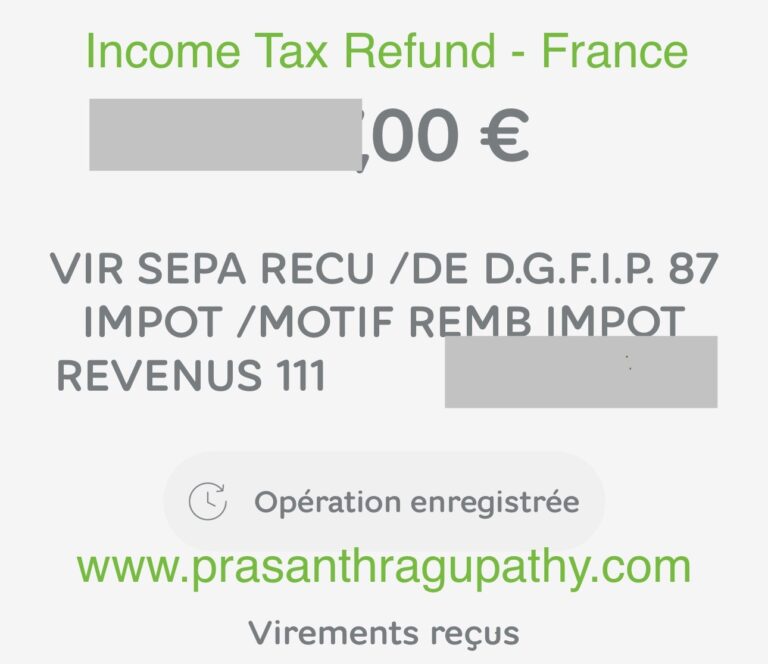

Starting today 24th July 2024, French Income Tax returns are being processed. Following your 2024 tax declaration, you may find yourself in one of two scenarios:

- You will receive a refund from tax department, if you had overpaid.

- You owe the tax department and must do a payment, if you had underpaid.

Since 1st January 2019, income tax is deducted at source (withholding tax, advance payment). The tax payment is regularized the following year during summer.

Reimbursement from Tax Department

You are eligible for a reimbursement,

- if the tax amount deducted in 2023 from your salary exceeds the final amount of your tax, or

- if you are entitled to a refund due to tax reductions or credits.

The details of your tax calculation will appear on your tax return “Avis d’imposition 2024” soon. The reimbursements are made either on 24th July or 31st July 2024,

- directly to the bank account that you provided during the tax declaration.

- if you have not provided a bank account, tax department will send a cheque to your home address.

Payment to Tax Department

You have an income tax balance to be paid to Impots,

- If the amounts deducted at source in 2023 were insufficient, because your % of tax deducted at source was less “prélèvement à la source”

- If you had received a bigger tax credit or advance tax reduction in January 2024, than what was required.

The amount to be paid will be taken directly from your bank account on 26th September 2024,

- in one go if the amount is less than or equal to €300.

- in 4 times (sept – dec) if the amount is greater than €300.

Have you noticed an error on your tax notice?.

“Your tax return can still be corrected from 31st July to 4th December 2024.

Take advantage of this opportunity!!”

2024 Dates to remember | |

Until 3rd July | Deadline to update your bank account with tax department (for refund) |

24th July to 29th August | Availability income tax notices online “avis d’impôt sur les revenus”. Offline paper declarations take little longer to be processed. Check your letter boxes regularly because the documents can arrive anytime between August and October. If you haven’t received any updates, you should contact your local tax office. |

24th and 31st July | Refund of overpayments or tax reductions and credits |

Until 15th September | Deadline to update your bank account with the tax department (for September payment) |

26th September | Single deduction of the remaining tax amount due, if it is less than or equal to €300 |

26th September 25th October 25th November 27th December | Withdrawal in 4 times of sums outstanding taxes exceeding 300 € |

Support This Blog!

If you’ve found my articles helpful, interesting or saving your time and you want to say thanks, a cup of coffee is very much appreciated!. It helps in running this website free for the readers.

Sources & References

- Impôt sur le revenu: remboursement ou solde à payer, qui est concerné?

Hello

I am not able to update my bank details on impots website . I had a case of offline paper declaration and I am due a refund . I can access my personal space but when I try to update bank details the option is grayed out .According to the above table , I lie in the situation which allows me to update the bank number by September 15th.

Please correct me if i am wrong here

Hello, please write to your tax office as explained on https://prasanthragupathy.com/2024/08/2024-income-tax-declaration-errors-online-correction-service-is-now-open/