In the Indian budget for 2024, significant revisions have been made to the capital gains tax rates, impacting investors and financial markets. Here’s a brief overview of the updated capital gains tax rates and their implications for taxpayers.

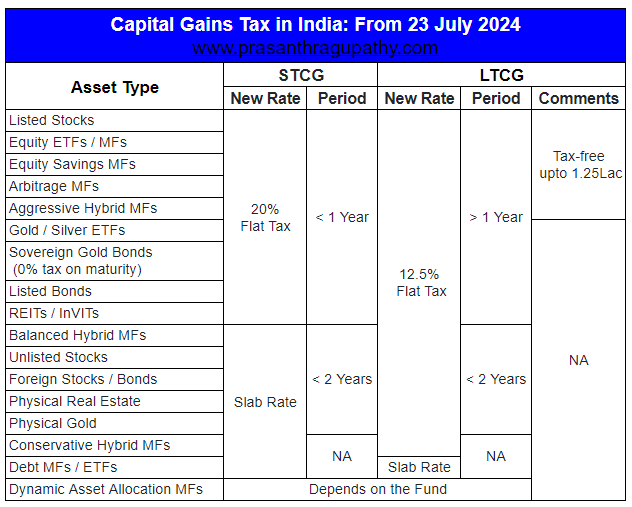

The table summary at the end lists the various financial assets and their capital gains tax rates.

Some Highlights on Investments

Capital Gains Tax

- Long Term Capital Gains Tax (LTCG) increased to 12.5% from 10% earlier.

- Limit of exemption from LTCG increased from ₹1 lakh to ₹1.25 lakh per year. This increased exemption limit will apply for FY 2024-25 and subsequent years.

- Short Term Capital Gains Tax (STCG) on certain financial assets increased to 20% from 15% earlier.

- LTCG on property sales reduced from 20% to 12.5%.

- The reduction in the rate will benefit all category of assets. In most of the cases, the taxpayers will benefit substantially. But where the gain is limited vis-a vis inflation, the benefit will also be limited or absent in a few cases

- Indexation benefits for property sales will be removed. This implies that individuals selling their property will no longer be able to adjust their purchase price using inflation, thereby reducing their capital gains.

Holding period

- Earlier there were 3 types of holding periods for considering an asset to be a long- term capital asset.

- Now the holding periods have been simplified. There are only two holding periods,- for listed securities, it is one year, for all other assets, it is two years.

- Therefore, for listed units of business trusts (ReITs, InVITs) holding period is reduced from 36 months to 12 months.

- The holding period of gold, unlisted securities (other than unlisted shares) is also reduced from 36 months to 24 months.

- The holding period of immovable property and unlisted shares remains the same as earlier i.e. 24 months.

Roll over benefits

- There is no change in roll over benefits already available under the IT Act.

- Therefore, taxpayers who want to save on LTCG tax even with low rates, can continue to avail the roll over benefits on fulfillment of conditions as applicable.

- For roll over benefits, taxpayers can invest their gains in house under section 54 or section 54F or in certain bonds under section 54EC.

- For complete details of all roll over benefits, please refer section 54, 54B, 54D, 54EC 54F, 54G of the IT Act.

- Investment of capital gain in 54EC bonds (up to Rs. 50 lakh) and in other cases, the capital gain is exempt from tax, subject to certain specified conditions.

Summary of New Capital Gains Tax Rates

The new capital gains rates came into force on 23rd July 2024 and shall apply to any transaction made on or after 23rd July 2024.

Conclusion

- The simplification of the tax structure will benefit from ease of compliance viz computation, filing, maintenance of records.

- This also removes the differential rates for various classes of assets.

- Overall, the Finance Ministry aims to simplify the taxation structure for individuals and has also proposed further tax measures for adoption of the new tax regime.

Sources & References

- FAQs issued by CBDT on the new capital gains tax regime proposed in the Union Budget 2024-25

- Budget 2024 personal taxation and capital gains proposals decoded

- Budget 2024: Experts weigh in on impact of capital gains tax hike on investor sentiment, mutual fund growth

New capital gains tax regime after Budget 2024: STCG, LTCG tax rates, exemption, holding period for equity share, debt, gold, property