Sending money internationally can be essential for various reasons, from supporting family abroad to conducting business. This article outlines the tax applicable on International remittances from India.

TCS % on Resident Bank Account

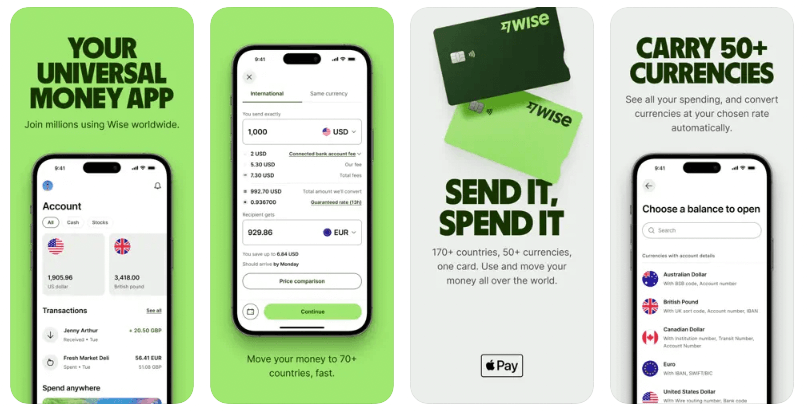

You can do international money transfers using direct bank-to-bank transactions or via the money transfer services listed on Which is the best online money transfer service?. Due to the introduction of TCS in India, some transfer services might not be available or have some limitations. A PAN card might be required too.

As per the Liberalised Remittance Scheme (LRS) regulations, you can transfer funds from India to overseas up to USD 250,000 per financial Year (April-March). This limit can be used for expenses towards,

- Private visits to any country (except Nepal and Bhutan)

- Gift or donation

- Going abroad for employment

- Emigration

- Maintenance of close relatives abroad

- Travel for business, or attending a conference or specialized training or for meeting expenses for meeting medical expenses, or check-up abroad, or for accompanying as attendant to a patient going abroad for medical treatment/ check-up

- Expenses in connection with medical treatment abroad

- Studies abroad

Tax Collected at Source (TCS) is applicable for international transfers from resident Indian bank accounts. The TCS paid can be used to offset your tax liability in India at the time of submitting your income tax declaration in India.

| Type of Transfer | TCS rate (from 1st October 2023) |

| Foreign education, financed by loan from financial institution | Nil up to ₹7 lakhs |

| 0.5% above ₹7 lakhs | |

| Foreign Medical treatment/ education (other than financed by loan) | Nil up to ₹7 lakhs |

| 5% above ₹7 lakhs | |

| Purchase of an foreign tour package | 5% up to ₹7 lakhs |

| 20% above ₹7 lakhs | |

| Other purposes | Nil up to ₹7 lakhs |

| 20% above ₹7 lakhs |

Note: NRIs cannot hold resident bank accounts in India.

Non-Resident Ordinary (NRO) Bank Account

- Tax Collected at Source (TCS) is not applicable for NRO bank accounts..

- No limit on repatriation of current income. For example: income from rent, interest, dividends, professional fees, and pension).

- Repatriation of capital income up to a maximum of USD 1 million per financial Year (April-March) is allowed. For example: income from Fixed Deposit (FD), sale of property, redemption of mutual funds, shares, etc.

- NRIs can transfer up to USD 1 million from their NRO account to their NRE account per financial Year (April-March).

Non-Resident External (NRE) or FCNR Bank Account

- Tax Collected at Source (TCS) is not applicable for NRE and FCNR accounts..

- No limit on the amount of funds you can transfer from your NRE or FCNR accounts.

Support This Blog!

If you’ve found my articles helpful, interesting or saving your time and you want to say thanks, a cup of coffee is very much appreciated!. It helps in running this website free for the readers.

Sources & References 📕

- Reserve Bank of India (RBI): FAQs on Liberalised Remittance Scheme

- SBI: Remittance from India – International Banking

DISCLAIMER

This post might contains affiliate links. If you click and make a purchase or open an account, I may earn a commission—at no extra cost to you. It helps in running this website.

Any finance-related information shared is not professional legal, tax, or investment advice. The information provided is of an educational and general nature and is not investment advice within the meaning of Articles L. 321-1 and D. 321-1 of the French Monetary and Financial Code. Investment carries risks of loss and past performance does not guarantee future performance. Please consult a financial advisor for any professional advice.