Last updated: December 08, 2025 | By: @rprasanth_kumar

The Plan d’épargne retraite (PER) is a French retirement savings plan, with the goal of simplifying and enhancing retirement savings options for individuals. The PER allows both employees and self-employed individuals to save for retirement with favorable tax incentives and flexible options for withdrawal.

Do you know that funds invested into your retirement accounts like PER can help reduce your income taxes in France?. You can also refer to the article, Difference between Tax Deduction, Tax Reduction & Tax Credit in France.

Reminder: You have until 31st December 2025 for making contributions to your PER account and claim tax deductions during the 2026 income tax declaration in France.

Good to know: It may not be an ideal investment if you are planning to leave France in a few years because the funds will be locked until your retirement age. Only a few exceptional situations can allow you to withdraw the funds before retirement. So, Invest only if you are comfortable with this system. If PER plans are not ideal for your situation, you an also go with an Assurance Vie.

What is a PER?

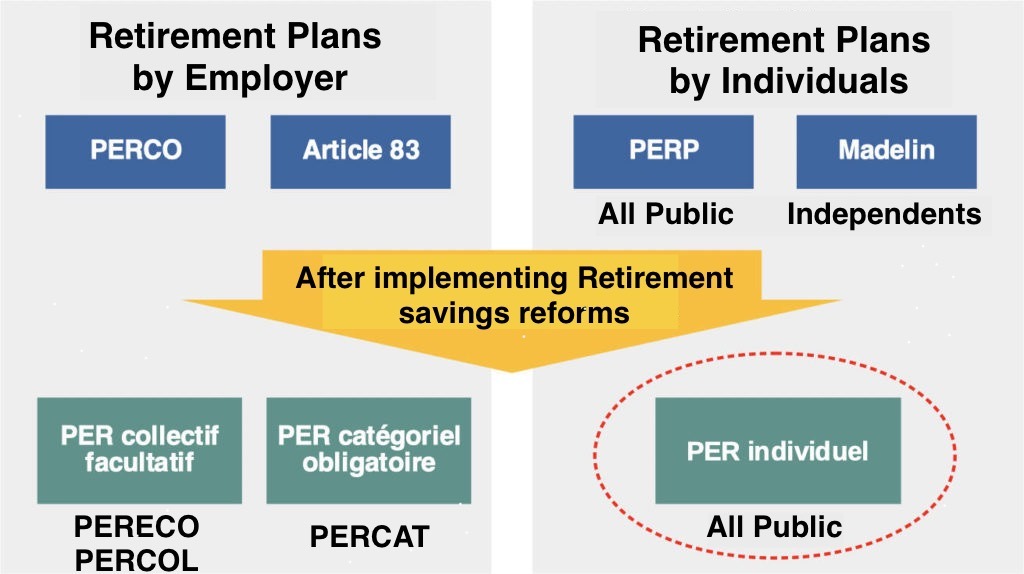

Plan d’épargne retraite (PER) is a type of long-term retirement savings account that regroups all old and existing retirement savings options into 3 categories.

- PERIn – PER individuel

- PER d’entreprise collectif – PERECO or PERCOL (from your Employer)

- PER d’entreprise obligatoire – PERCAT (from your Employer).

These new PERs have been available since 1st October 2019 and gradually replaced all the old options like PERCO, PERP, Madelin, etc.

Payments during the course of a financial year (Jan-Dec) are deductible from the taxable income of that year, within the limit of an overall ceiling for each member in the household. The maximum limit of investments eligible for tax reduction is equal to the higher of the 2 following situations:

- 10% of the professional income of 2025, net of social security contributions and professional expenses, or

- a maximum deduction of 35,195 €.

The limit is increased by any unused deduction limit (or fraction of the limit) from the previous three years, applied from the oldest to the most recent. For Example: If you didn’t fully use your deduction limit in 2023 and 2024, your 2025 contributions are deducted first from your 2025 limit. Any amount exceeding the 2025 limit is then deducted from the remaining portion of your 2023 limit, followed by the remaining portion of your 2024 limit.

If you haven’t used the tax benefits for this year, it can be carry forwarded to 3 consecutive years. To know more, read this article from Cotisations d’épargne retraite (déduction).

Note: If you don’t deduct these payments from your taxable income, you will have a tax advantage when you withdraw funds after retirement. The withdrawals will be tax-free.

Why is a PER required?

- To create a long term retirement corpus, while you are actively employed or doing a business.

- To reduce your taxable income, especially when you are in 30% tax bracket or higher. If you are in 0% or 11% tax bracket, an PER is not a good option.

- An ideal scenario for using PER is that you are at a higher tax bracket before retirement and lower tax bracket after retirement. Explained using an example later.

How to open a PER account?

You can open a PERin account with your bank, insurances, third-party brokers, etc. Other 2 PERs can only be opened via your employer.

Some options for PERin accounts:

- PERIn MATLA from Bourso Bank.

- Other Banks like BNP Paribas, etc.

- Brokers suc as Boursdirect, Yomoni, Linxea, etc.

What can be invested in a PER?

You can make the following payments to your PER accounts.

- Voluntary contributions by the account older. There is no limit on these voluntary cash payments, but the amount for which you can benefit from a tax advantage is capped to a certain limit every year.

- Mandatory contributions (by you and your employer) to a PER d’entreprise obligatoire.

- Intéressement: A direct performance incentive plan allowing employees to receive a bonus according to their individual contribution to company’s performance. This mechanism aims to motivate employees by aligning their financial rewards with the company’s objectives, creating a win-win dynamic. It’s often used by companies to encourage greater employee engagement in achieving specific performance targets.

- Participation: It is a mandatory profit-sharing mechanism. It requires eligible companies to redistribute a portion of their annual profits to employees, reflecting a commitment to equitable financial sharing rather than direct performance incentives. Participation allows employees to benefit from the company’s success and receive a share of profits that is separate from their salary.

- Abondement: Employer matching contributions that some employers make to supplement the amounts their employees invest in workplace PER savings plans. The employer’s contribution cannot exceed 3 times the amount you paid yourself, nor be higher than € 7,419. But it is not applicable for PER d’entreprise obligatoire.

- Transfer from a Compte épargne temps (CET) account which allows an employee to accumulate unused paid leaves or breaks.

- In the absence of a CET, amounts corresponding to days off not taken (jours de repos non pris), up to 10 days per year.

Note: You can also transfer amounts from another PER d’entreprise, PER individuel or other old retirement savings product (PERP, Madelin, Perco, etc.) to your PER accounts.

When to invest in a PER?

- Regular monthly contributions or few lump-sum payments based on your account terms and conditions.

- Irrespective of the automatic or manual payments, the funds will be invested based on the mandate chosen during account opening. However, the investment mandate can be updated.

- Payments made between 1st January and 31st December during a year, are are eligible for income tax reduction of the same year.

Example Calculation of Tax Deduction

To know the tax benefit, you have to multiply the total amount invested in PER with your tax rate (called taux marginal d’imposition TMI in French)

For example, if your tax rate is 30% and you had invested 5000€ in 2025, you can reduce 1500€ from your income taxes on the income earned in 2025.

- 5000€ x 0% = Nothing

- 5000€ x 11% = 550€

- 5000€ x 30% = 1500€

- 5000€ x 41% = 2050€

- 5000€ x 45% = 2250€

If your tax bracket is 0% or 11%, investing in PER may not be a wise choice. After retirement, your annual income might be lower and you might in a lower tax bracket. You can do an online simulation available here.

Withdrawal of Funds

After Retirement: Can be partially or completely withdrawn at retirement including monthly withdrawals as pension.

Before Retirement: Can be withdrawn before retirement, based on some exceptional situations such as

- Disability (you, your children, your spouse or your partner).

- Death of your spouse or PACS partner.

- Expiry of your rights to unemployment benefits.

- Bankruptcy.

- Buying your first house

Tax on Withdrawal of Funds

Taxation applies when withdrawing funds from the PER, and it depends on two factors:

- Your choice at withdrawal: either as an annuity (rente) or a lump sum (capital).

- Whether or not you took advantage of tax deductions when contributing to the PER account.

Early Withdrawal (Déblocage Anticipé)

For Life Events (e.g., serious accidents):

- Capital (if contributions were tax-deducted): Income tax is exempt.

- Capital (if contributions were not tax-deducted): Income tax is exempt.

- Capital gains: Subject to social charges.

For Primary Residence Purchase:

- Capital (if contributions were tax-deducted): Taxed based on your income tax bracket.

- Capital (if contributions were not tax-deducted): Income tax is exempt.

- Capital gains: Taxed at a flat rate of 30%.

Standard Withdrawals at Retirement

Annuity Payments (Sortie en Rente):*

- If contributions were tax-deducted: Subject to taxation as “pensions and retirement income” under the rentes viagères à titre gratuit (RVTG) category. Tax is calculated according to your marginal tax rate (TMI) after a 10% allowance.

- If contributions were not tax-deducted: Taxed under rentes viagères à titre onéreux (RVTO), meaning only a fraction of the annuity is taxable. The taxable percentage depends on your age at the start of payments (e.g., 40% taxable if aged 60–69).

Lump-Sum Withdrawals (Sortie en Capital):

- If contributions were tax-deducted:

- Contributions: Taxed based on your income tax bracket.

- Capital gains: Taxed at a flat rate of 30% (social charges included). You can opt for income tax bracket if your marginal tax rate is 0% or 11%.

- If contributions were not tax-deducted: Only capital gains are taxed at a flat rate of 30%.

DISCLAIMER

Any finance-related information shared is not professional legal, tax, or investment advice. The information provided is of an educational and general nature and is not investment advice within the meaning of Articles L. 321-1 and D. 321-1 of the French Monetary and Financial Code. Investment carries risks of loss and past performance does not guarantee future performance. Please consult a financial advisor for any professional advice.

Hi,

Please advise if the retirement benefit applicable for all type of RP.. especially passport talent holders.

What is the retirement age in France?

If we go back to India before the retirement age, still we eligible to get it? What’s the process to avail this benefit at high level?

Thanks for the detailed guide.

Hello Meenakshi,

Yes, it is applicable for people with Passeport talent residence permits too.

Also, Please refer to my explanations in https://prasanthragupathy.com/2023/06/faq-what-is-the-minimum-duration-required-to-qualify-for-pension-in-france/