Published on: October 17, 2024 | By: @rprasanth_kumar

The 2025 Finance Bill in France introduces significant tax changes for non-professional furnished rental property owners (LMNP), aiming to level the playing field between furnished and unfurnished rentals. By including depreciation in capital gains calculations and encouraging long-term rentals, the French government seeks to curb speculation, stabilize property prices, and promote more sustainable rental markets.

The finance bill (Le projet de loi de finances pour 2025) arrives in the National Assembly for discussion on 21st October, then in the Senate from 26th November. The final version will be available only in December 2024.

Changes for Non-Professional Furnished Rentals (LMNP)

Tax Increase on Furnished Rentals

- The French government plans to raise taxes on properties rented as non-professional furnished rentals (Loueur en Meublé Non Professionnel – LMNP).

- The goal is to equalize the tax treatment of furnished and unfurnished rentals, making the market fairer and reducing speculation.

Proposed Change in Capital Gains Calculation

- Currently, owners benefit from depreciation, which allows them to deduct property, renovation, and furniture costs from taxable income.

- This depreciation is not factored into capital gains when selling, creating a financial advantage.

- Under the new bill, depreciation will be included in the capital gains calculation, reducing this benefit from 1st January 2025.

- Example: If a property bought for €200,000 is sold for €500,000 with €75,000 in depreciation, the taxable gain will now be €375,000 instead of €300,000.

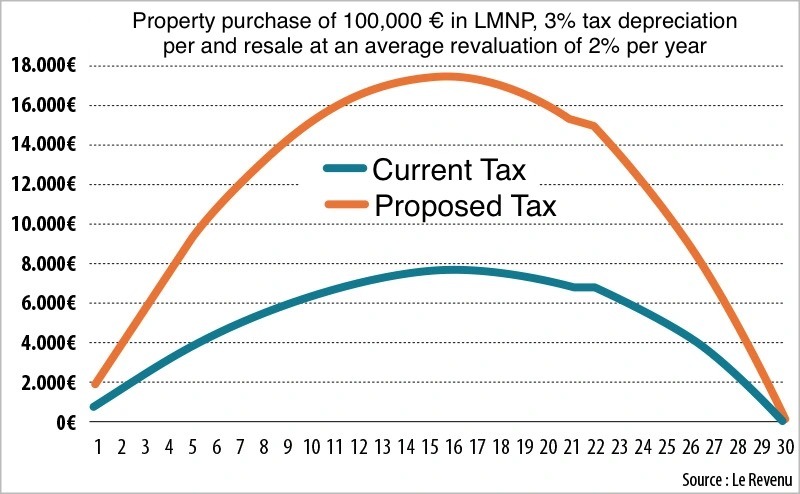

Impact Over Time

- The Ministry of Finance estimates this reform will generate additional revenue of €180-200 million per year.

- The tax impact will be strongest on properties sold after 15 years of ownership but will decrease for properties held longer (e.g., after 25 years, the effect will be negligible).

- The reform aims to push landlords toward long-term rentals over short-term options (like Airbnb), promoting housing stability for residents in France.

Some alternatives for Rental Property Owners

- Opt for Long-Term Rentals: Benefit from tax reductions and lower vacancy rates with longer rental contracts.

- Use Tax Incentives: Take advantage of programs like Loc’Avantages (tax reduction) or the Loi Denormandie (tax reduction) for investments until 31st December 2027.

- Switch to the Régime Réel: Deduct actual expenses (e.g., management fees, renovation, loan interest) even without depreciation. For more details, Le régime réel des locations meublées et la réduction d’impôt.

- Switch from LMNP to LMP Status: If your rental income exceeds €23,000 and is over 50% of household income, LMP (Loueur en Meublé Professionnel) status offers tax benefits like depreciation. For more details, Tax treatment of the professional furnished tenant (LMP).

- Invest in SCPI: Co-own real estate and receive passive rental income without managing properties directly. Fore more information, SCPI: Know the risks and return on this investment.

Support This Blog!

If you’ve found my articles helpful, interesting or saving your time and you want to say thanks, a cup of coffee is very much appreciated!. It helps in running this website free for the readers.

Sources & References 📕

- Le projet de loi de finances pour 2025

- Impôt sur le revenu – Revenus d’une location meublée

- Projet de loi de finances pour 2025 presented on 10 October 2024

- Propositions de réforme de la fiscalité locative, Annaïg Le Meur, députée du Finistère, mai 2024.

News Articles