Published on: February 19, 2025 | Article No: 303 | By: @rprasanth_kumar

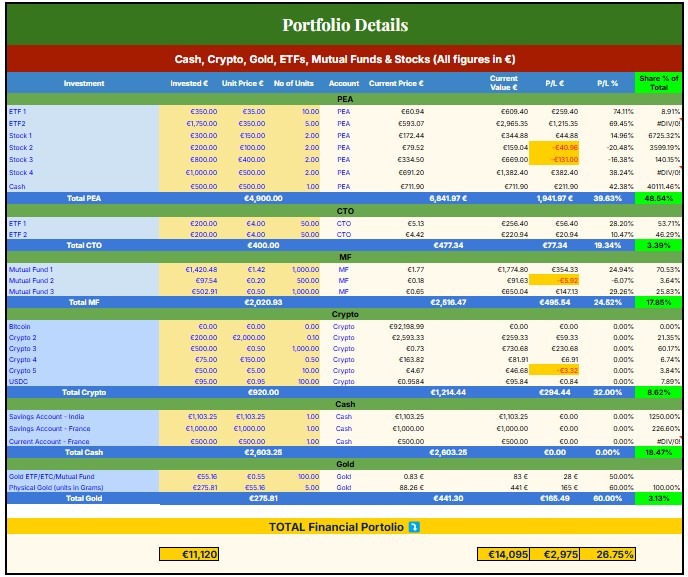

Managing personal finances can be overwhelming without the right tools. A well-structured Income, Expenses, Savings, and Investments Portfolio Tracker Dashboard can simplify this process by offering a comprehensive overview of your financial health.

This free template helps you effortlessly track income sources, monitor spending patterns, set savings goals, and manage investment portfolios. Whether you’re just getting started with budgeting or are a seasoned investor, this dashboard is designed to keep your finances organized and optimize your path to financial freedom.

Some Screenshots from the Template

Free Template: Portfolio Tracker Dashboard

Some important points about this free template.

- You can make a copy of this sheet for personal use and share it with your friends, family, etc.

- Feel free to add your comments about this sheet, especially about additional tabs, assets, taxes, etc.

- Version_1.0 is a very basic toned down version of my own portfolio dashboard and I will update it regularly with a lot more functionalities, charts, etc.

- Replace the dummy data (cells without formulas) with your own data.

- Any Stock, ETF, Mutual Funds, etc. and their values present in this sheet are only examples. They are recommendations and do not represent an actual portfolio.

- Freely available Google Finance data and formulas have been used for calculating the current values of the investments, forex conversions (INR to EUR), etc.

- Sometimes, there is a delay of a few hours to few days in fetching the latest data by Google Finance. For a long-term portfolio, its not really a concern.

Support This Blog!

If you’ve found my articles helpful and you want to say thanks, a cup of coffee or two is very much appreciated!. Please help keep it going!

DISCLAIMER

Any finance-related information shared is not professional legal, tax, or investment advice. The information provided is of an educational and general nature and is not investment advice within the meaning of Articles L. 321-1 and D. 321-1 of the French Monetary and Financial Code. Investment carries risks of loss and past performance does not guarantee future performance. Please consult a financial advisor for any professional advice.

Hi Prasanth,

This seems like great work! A bit overwhelming to start with to put all my data in there. I hope to find some time to give it a try :).

I have a question though. In the portfolio sheet, there is only 1 line per investment instrument. If the investment is a regular one, like monthly, my assumption is a line needs to be added for each month for that instrument so that the Unit price and no. of units can be put in. Is this correct or is there another mechanism to do that in that template?

Thanks

Rohit

Hello Rohit,

It is an example and so you do not have to follow exactly the same way. Feel free to adapt it according to your personal needs. Feel free to suggest any improvements, including more automations.

Yes, only 1 line per investment instrument because it is a total of everything invested during a month for (simplicity). So, just 5-10 mins is required to add details at the end of every month. I do it on the last day of the month or the following weekend.

Cheers,

Prasanth

PS: If my articles and answers are helpful, please leave your feedback on Trustpilot