Published on: February 24, 2025 | Article No: 306 | By: @rprasanth_kumar

Buying your first home is an exciting milestone, but it can also be a daunting financial endeavor. Fortunately, the French government offers a helping hand through the interest-free loan, known as the Prêt à Taux Zéro (PTZ). This scheme is designed to support first-time homebuyers by providing interest-free financing for a portion of their primary residence purchase.

Whether you’re considering a new build or an existing property needing renovation, the PTZ can make home ownership more accessible in France. In this comprehensive guide, we’ll walk you through everything you need to know about the PTZ, from eligibility criteria to loan repayment terms.

Summary of PTZ,

- What is the PTZ? A government-backed, interest-free loan to help first-time buyers purchase their primary residence.

- Eligibility Criteria: Income thresholds, property type, and location-based zones determine eligibility.

- Income Ceilings: Vary based on the property’s zone and the number of occupants.

- Loan Amount: Depends on property type, purchase price, location, and household size.

- Repayment Terms: Typically range from 20 to 25 years, with deferment options available.

- Application Process: Available through participating financial institutions.

- 2025 Changes: The 2025 Budget Law extended the PTZ to all new properties across France until December 31, 2027.

A loan is a commitment and must be repaid. Always verify your borrowing and repayment capacity before committing.

Topics Covered 📚

What is Prêt à Taux Zéro (PTZ)?

The Prêt à Taux Zéro (PTZ) is a French government-backed, interest-free loan designed to assist first-time homebuyers in purchasing their primary residence. It offers financing for a portion of the property cost, with eligibility based on income thresholds and property location. The PTZ aims to make homeownership more accessible, with repayment terms typically ranging from 20 to 25 years.

Key features of the PTZ

- Interest-Free: No interest charges.

- No Administrative Fees: No additional costs for processing the loan.

- Duration: The loan term cannot exceed 25 years.

Where to apply for a PTZ housing loan? Only financial institutions that have signed an agreement with the government can offer PTZs. You can apply directly to the bank of your choice, but approval is not guaranteed.

Eligibility criteria for Prêt à Taux Zéro (PTZ)?

To qualify for a PTZ, you must not have owned your primary residence in the past two years. Exceptions apply if:

- You hold a disability card or a mobility inclusion card (CMI) with the “invalidity” mention.

- You receive disability benefits or are responsible for a disabled child.

- You are a victim of a disaster that rendered your primary residence permanently uninhabitable.

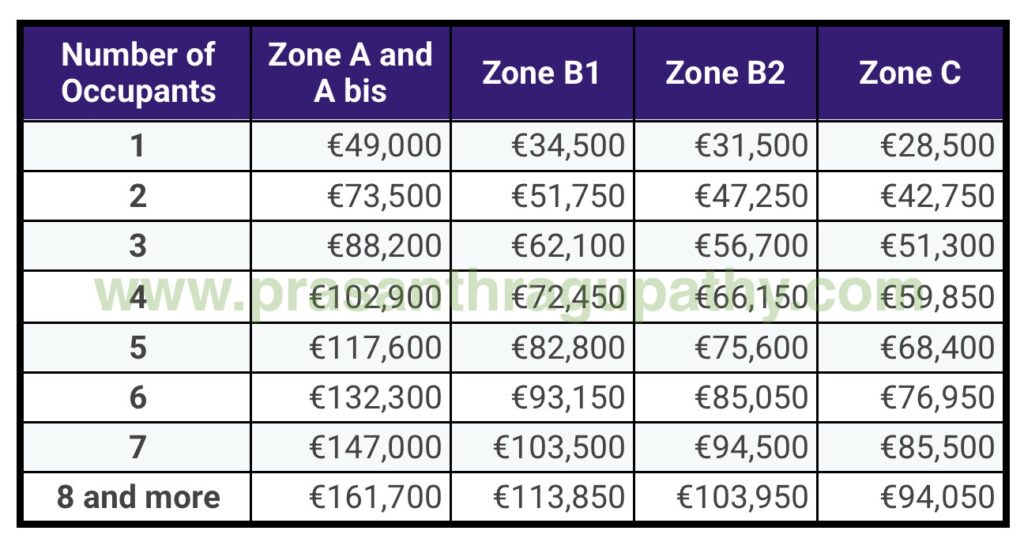

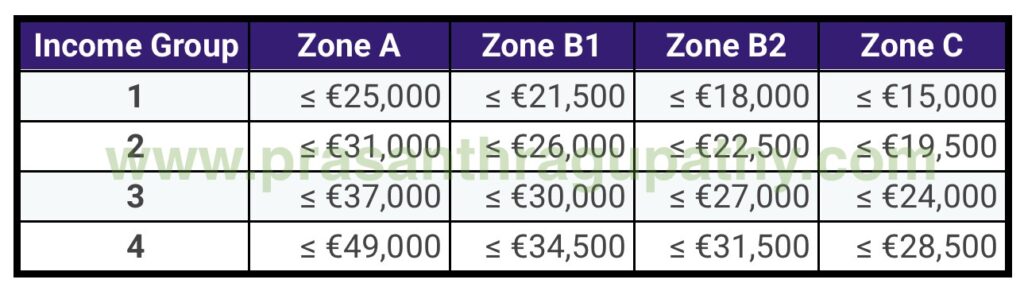

Income Thresholds for PTZ Eligibility: To qualify for a PTZ, your income must not exceed certain thresholds, which vary based on the property’s location and the number of occupants. The income considered is the tax reference income (revenu fiscal de référence) from two years prior (N-2) for all future occupants.

Zone System for PTZ: France is divided into several zones to determine the eligibility and terms for PTZ:

- Zone A: Includes the Paris metropolitan area (including Zone Abis), the Côte d’Azur, the French part of the Geneva metropolitan area, and certain other municipalities (e.g., Lille, Strasbourg, Lyon, Marseille, Montpellier, Toulouse, Bordeaux, Nantes, and Rennes), as well as 10 overseas department communes where rents and property prices are very high.

- Zone A bis: Part of Zone A, includes Paris and 97 other communes in Île-de-France, plus 26 communes in the provinces.

- Zone B1: Includes large metropolitan areas and communes with high rents and property prices, parts of the greater Paris area not in Zones Abis or A, certain provincial cities, and overseas department communes not in Zone A.

- Zone B2: Includes city centers of large metropolitan areas, the greater Paris area not in Zones Abis, A, and B1, certain communes with fairly high rents and property prices, and communes in Corsica not in Zones A or B1.

- Zone C: The rest of the territory.

When can you obtain a Prêt à Taux Zéro (PTZ)?

A PTZ can be granted for:

- Purchasing an older property in a relaxed zone, provided you undertake renovations that improve energy performance.

- Buying or building a new property in a high-demand area.

- Purchasing social housing where you currently reside.

- Buying through a lease-to-own contract.

- Acquiring real estate rights under a real estate solidarity lease.

- Purchasing a property with a reduced VAT (TVA) rate.

- Converting an existing commercial space into a residence.

Support This Blog!

If you’ve found my articles helpful and you want to say thanks, a cup of coffee or two is very much appreciated!. Please help keep it going!

How is the PTZ loan amount determined?

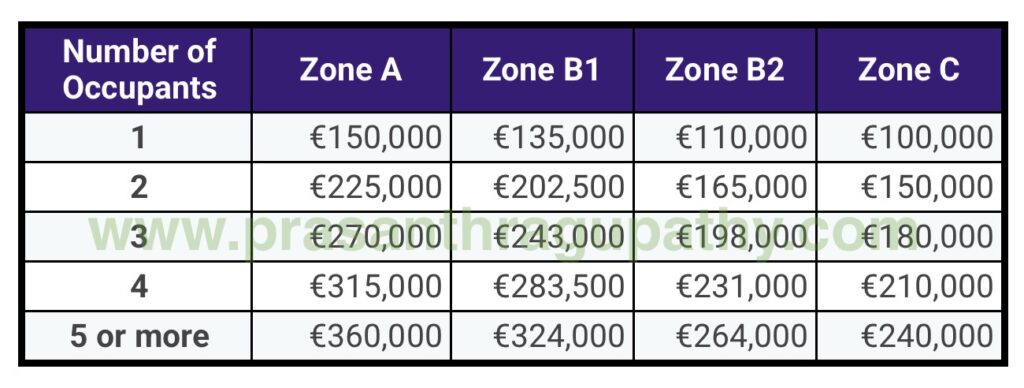

The PTZ amount depends on several factors:

- Property Type: New or existing.

- Purchase Price: The cost of the property.

- Location: The zone where the property is situated.

- Occupants: The number of people who will live in the property.

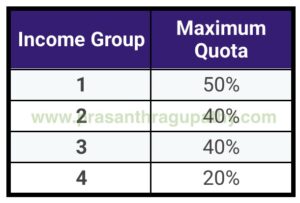

PTZ Quotas: The amount of your PTZ loan is equal to a portion of the total purchase cost within a certain threshold, to which a quota applies. Since 1st April 2024, this cap has been increased to 50% of the total cost, up from 40%.

Income Group Classification: The above quota is determined based on your classification within specific income groups, which are established according to the total income of the individuals intended to occupy the residence, divided by a family coefficient.

Transaction limits used to determine the amount of PTZ: The maximum cost of the real estate transaction, which determines the PTZ amount, is based on the number of occupants in the residence and the zone in which the property is located.

PTZ housing loan repayment period?

The repayment terms for a PTZ depend on:

- Household Composition: The number of people in your household.

- Income: The total income of all occupants.

- Location: Where the property is situated.

The repayment period typically ranges from 20 to 25 years. You can defer payments for up to 15 years under certain conditions. The PTZ loan can be repaid in 2 ways:

- In a Single Period: You make regular payments throughout the loan term.

- In Two Periods: When there is a deferred repayment, you do not repay your PTZ during the first period (the deferment period).

List of Documents required for PTZ loan application?

Before submitting your PTZ application to your chosen lending institution, you must gather the following mandatory documents:

- Identification: Valid IDs for all future borrowers (ID card, passport, European driver’s license, residence permit) and documents proving civil status (family record book, marriage contract, divorce decree, cohabitation certificate).

- Tax Return: The tax return for the previous year (N-1) for the household.

- First-Time Buyer Declaration: A declaration of honor that you are a first-time buyer.

- Financial Documents: All documents related to your project’s financing (project financing plan, mortgage amortization schedules).

- For the purchase of:

- New Property: Contract of reservation, property development contract, lease-to-own contract, or preliminary contract.

- Existing Property with Renovations: Declaration of honor of planned improvements, quotes, and invoices.

- If you are housed by someone else:

- A declaration of honor from the person housing you and proof of non-ownership of the property (property tax of the owner or tenant’s lease contract).

- If you are a tenant:

- The lease contract for the past two years.

- Proof of the last rent receipt and receipts for the past two years, every six months.

Obligations for Prêt à Taux Zéro (PTZ)?

In summary, when applying for a PTZ, the future borrower must respect the following obligations,

- Not having owned their primary residence in the past two years.

- Purchasing and maintaining the property as their primary residence for at least six years (except in special cases).

- Buying a new property or an existing one with renovations, adhering to zoning criteria.

- Supplementing the PTZ with a primary loan.

PTZ, PTZ+, and Eco-PTZ: Understanding the differences

- The PTZ and PTZ+ are essentially the same loan, with the name prêt à taux zéro plus referring to modifications made in 2011.

- However, there is another interest-free loan available known as éco-prêt à taux zéro (éco-PTZ).

- Eco-PTZ: This loan is specifically for financing improvements in a property’s energy performance. It is available without income restrictions and applies across the entire territory.

Conclusion: In a nutshell, the PTZ is all about making that leap into homeownership a bit more accessible. It’s a supportive tool that can lighten the financial load for first-time buyers, ensuring that more people have a shot at owning a home. If you are ready to explore this option, a little research and some professional advice can set you on the path to turning those home-owning dreams into a reality.

Support This Blog!

If you’ve found my articles helpful and you want to say thanks, a cup of coffee or two is very much appreciated!. Please help keep it going!

DISCLAIMER

Any finance-related information shared is not professional legal, tax, or investment advice. The information provided is of an educational and general nature and is not investment advice within the meaning of Articles L. 321-1 and D. 321-1 of the French Monetary and Financial Code. Investment carries risks of loss and past performance does not guarantee future performance. Please consult a financial advisor for any professional advice.

Do you provide accommodation to under 18 years old accommodation in Nice, France

Hello Rohan,

I am not providing any such professional services including accommodation. FYI https://prasanthragupathy.com/2023/07/accommodation-for-students-in-france/

Cheers,

Prasanth

PS: If my articles and answers are helpful, please leave your feedback on Trustpilot