Updated on: April 08, 2025 | By: @rprasanth_kumar

An ETF (Exchange Traded Fund) is a basket of investment options such as stocks, bonds, commodities like gold, etc. It allows buying a group of stocks in a single transaction, without the need to buy these stocks individually. ETFs are known for their very low expense ratios and broker commissions.

This article focuses on the investors in France and Europe. However, a lot of information is generic and might be applicable outside Europe too.

What is a MSCI World Index?

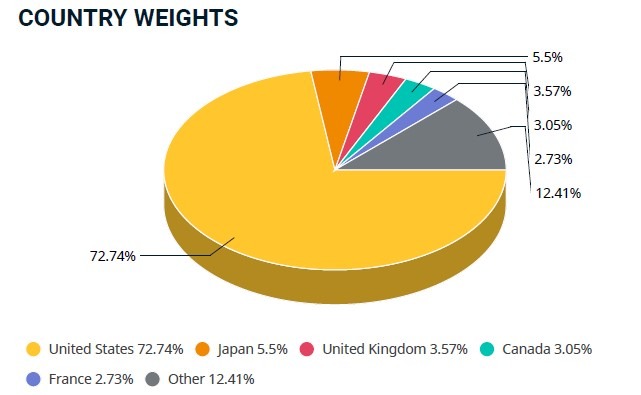

The MSCI World Index, launched in 1986, is a well-known benchmark that measures the performance of equity markets across 23 developed countries. It currently consists of 1,400-1500 large and mid-cap stocks from these countries, with the USA accounting for around 70% of them.

The index is based on the MSCI Global Investable Indexes (GIMI) Methodology and invests in the following countries.

- AMERICAS – Canada and USA.

- EMEA – Austria, Belgium, Denmark, Finland, France, Germany, Ireland, Israel, Italy, Netherlands, Norway, Portugal, Spain, Sweden, Switzerland and UK.

- APAC – Australia, Hong Kong, Japan, New Zealand and Singapore.

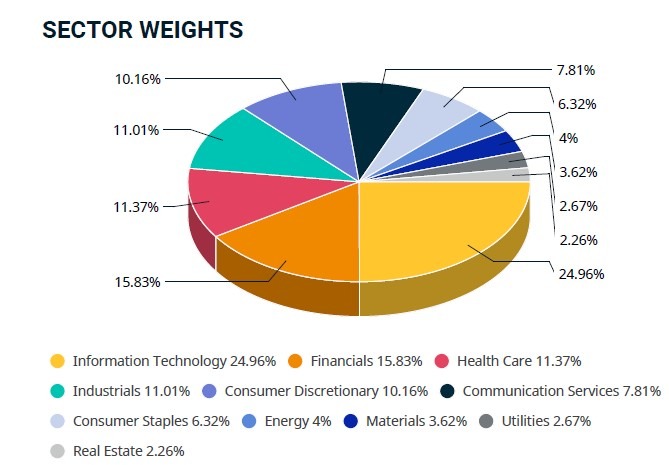

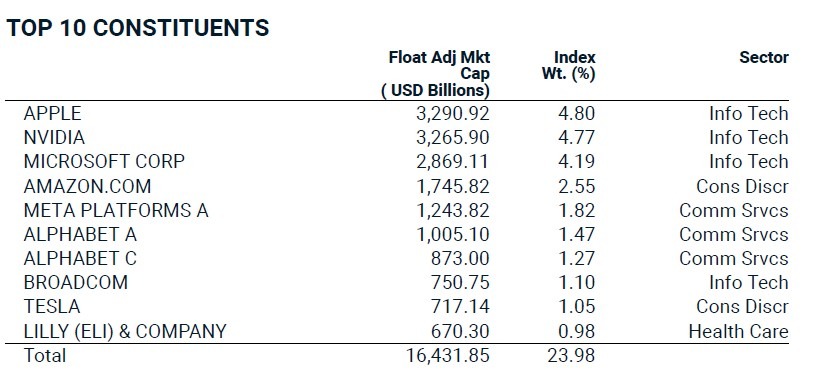

You can find the top-10 stocks, sector-wise, and country-wise allocations in the charts below, as of November 2024.

MSCI World Index’s performance?

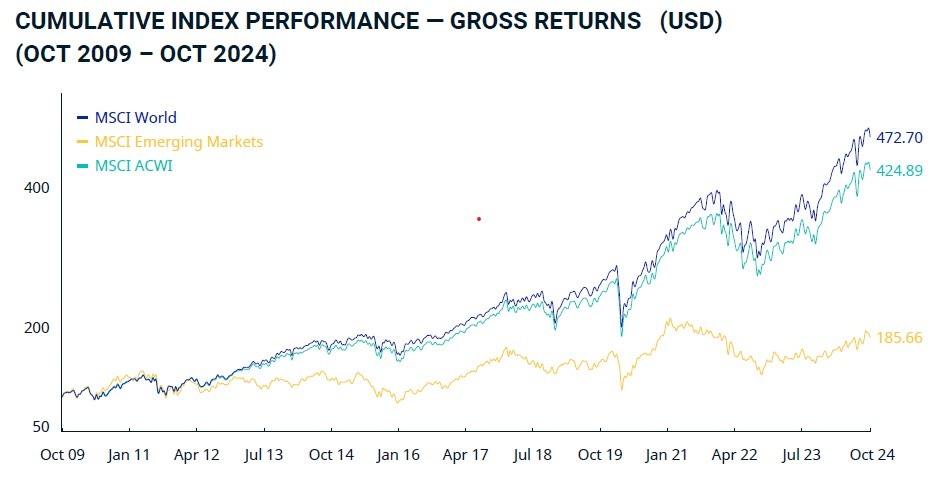

The MSCI World index has given a net return of 10-11% in the last 10 years.

How to invest in MSCI World Index?

Multiple ETFs track the MSCI World Index. These ETFs invest in stocks, which are part of the index. So, the performance of the ETFs should be very close to its benchmark index. A concept known as tracking error measures the deviation in performance of the ETF and its index. So, you should choose the ETFs with the lowest tracking error.

Various assets management companies such as Amundi, Blackrock (iShares), Invesco, etc have their MSCI World ETF versions.

Which MSCI World ETF to invest?

There are normally 2 types of ETFs,

- Accumulating (ACC) / Capitalisation (C): Dividends are reinvested automatically.

- Distribution (Dist) / Distribuant (D): Dividends are paid to the investors.

It is highly recommended to invest in the accumulating ETFs, so the dividends are reinvested. This helps your investments to keep compounding over time and also avoid the flat tax on dividends every year.

You can invest in a MSCI Index ETF via the following accounts, depending on where you live.

CTO – Brokerage Account (Europe)

The following ETFs are available in a regular brokerage account (CTO). You can open a CTO account with regular banks and also brokers such as Boursedirect, Degiro, Interactive Brokers, Trade Republic, Trading212, etc. Some of these ETFs may not be available with all these brokers. So, choosing the right broker is very important.

- AMUNDI INDEX MSCI WORLD UCITS ETF DR (C)

- LYXOR MSCI WORLD UCITS ETF – ACC

- iShares MSCI World EUR Hedged UCITS ETF (Acc)

- iShares MSCI World SRI UCITS ETF

The above list is not exhaustive and there are a lot more ETFs available in the market.

PEA (France)

The Plan d’épargne actions (PEA) is a regulated savings and investment account available only to residents in France. It makes it possible to acquire and manage a portfolio of shares of European companies while benefiting from certain tax exemptions. If you are living in France, a PEA account should be your primary option for investing in shares, ETFs, etc. This account can be complimented by a CTO account, especially for securities that are not available in the PEA.

There are only 2 MSCI World Index ETFs that can be invested using a PEA account.

- AMUNDI MSCI WORLD UCITS ETF – EUR (C) (0.38% TER)

- Amundi PEA Monde (MSCI World) UCITS ETF (0.20% TER)

- iShares MSCI World Swap PEA UCITS ETF (0.25% TER)

Assurance Vie & PER (France)

If your Assurance Vie and French retirement investment accounts have these ETFs, you can choose them. So, this is one of the important points to check while opening these type of accounts.

Does MSCI World ETF pay dividends?

The MSCI World Index has hundreds of companies that pay ample dividends. So, MSCI World Index ETF will pay dividends too.

- If you have chosen an accumulating ETF, these dividends will be reinvested.

- If you have chosen a distributing ETF, these dividends will be paid to your brokerage account periodically.

The average dividend yield from a MSCI World Index ETF is currently 1.98%.

Is MSCI World ETF enough for your portfolio?

Though these ETFs invest in 23 developed countries, the emerging markets are very important too. Also, around 70% of the MSCI World Index ETF is invested in a single country.

So, there is ample scope for diversification with other ETFs outside the MSCI World Index. You can invest in developing markets, specific sectoral ETFs, individual countries, etc.

Other options for Index ETFs?

Here is a list of other Indexes that can complement the MSCI World Index. You can invest in the various ETFs tracking these indexes.

- S&P500 Index, which invests in top 500 large-cap U.S. companies and covers approximately 80% of available market capitalization.

- Nasdaq-100 Index, which invests in 100 of the largest non-financial tech companies listed on the Nasdaq Stock Market.

- Emerging Markets Index, which invests in 24 developing markets including China, India, etc, and accounts for nearly 11% of the global equities.

- Dow Jones Industrial Average Index, which invests in 30 U.S. blue-chip companies and covers all industries except transportation and utilities.

- Euro Stoxx 50 Index, which invests in 50 largest companies in the Eurozone and covers 20 sectors.

- FTSE 100 Index, which invests in the top 100 companies listed on the London Stock Exchange.

Sources & References

Disclaimer

- Any finance-related information shared is not professional legal, tax, or investment advice.

- The information provided is of an educational and general nature and is not investment advice within the meaning of Articles L. 321-1 and D. 321-1 of the French Monetary and Financial Code.

- Investment carries risks of loss and past performance does not guarantee future performance.

- For all professional advice, please consult a certified financial planner, CGP, CIF, tax consultant, etc.

Hi Prasanth,

Any recommendations for Eurozone ETFs eligible for PEA?

The unit price of AMUNDI MSCI WORLD UCITS ETF – EUR (C) is quite high, so I decided to start with iShares MSCI World Swap PEA UCITS ETF for the MSCI world index.

Thanks

Rohit

Hello Rohit,

Updated the article with a new MSCI World ETF (DCAM) from Amundi. Personally, I have moved from CW8 to DCAM.

Cheers,

Prasanth

PS: If my articles and answers are helpful, please leave your feedback on Trustpilot