Summary of the Federal Reserve Press Conference on 1st Nov 2023

FOMC leaves interest rates unchanged at 5.25% – 5.50% range.

- Continue to reduce securities holdings at a brisk pace.

- 2nd consecutive meeting that the Federal Open Market Committee (FOMC) chose to pause the interest rates hikes.

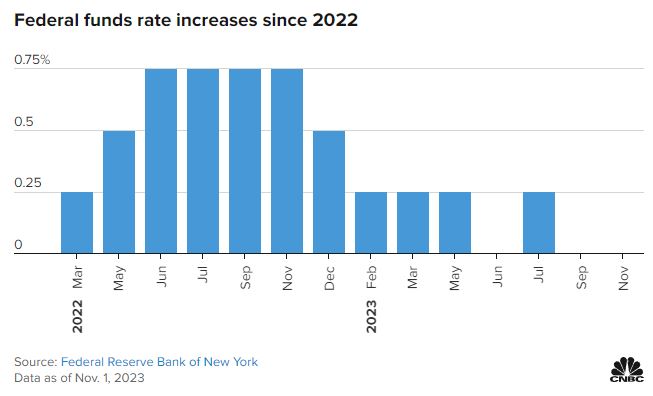

- Since March 2022, there have been 11 rate hikes, including 4 in 2023.

- FOMC not considering or even discussing rate reductions at this time.

- US unemployment rate remains low, at 3.8 %.

- In the 3rd quarter, real GDP is estimated to have risen at an outsized annual rate of 4.9 %, boosted by a surge in consumer spending.

- Housing sector has flattened out and remains well below levels of a year ago, largely reflecting higher mortgage rates.

- Higher interest rates also appear to be weighing on business fixed investment.

- FOMC members observe robust economic growth and so do not anticipate a recession anytime soon.

- Strongly committed to returning inflation to its 2 % objective.

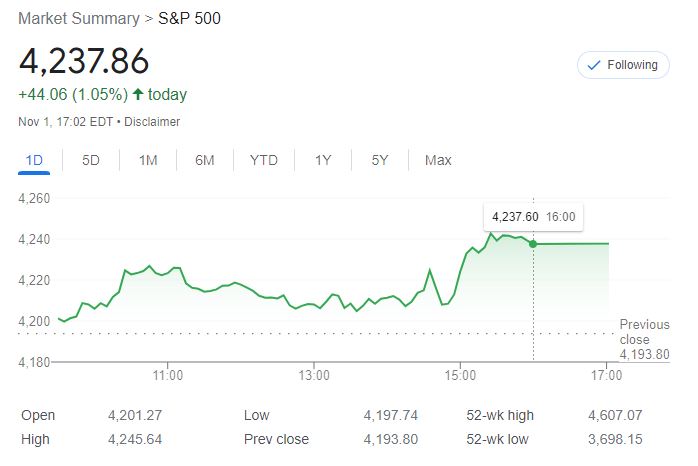

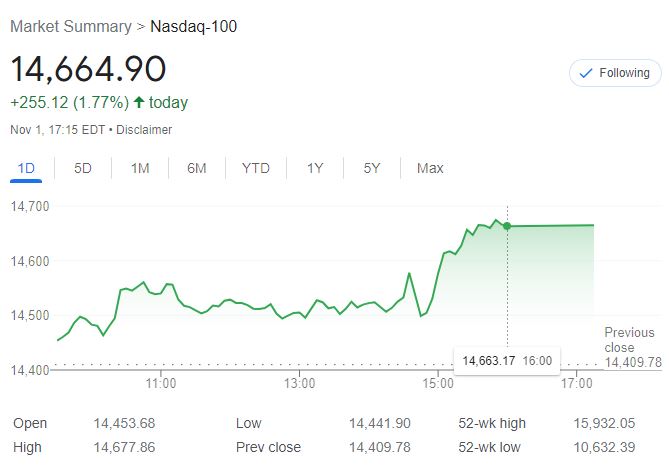

Wall street reacted positively with S&P500 and Nasdaq100 rising by 1.1% and 1.6% respectively after the meeting.

Sources & References

- Transcript of Chair Powell’s Press Conference Opening Statement – 1st Nov 2023

- The official press release from the United States Federal Reserve from 1st Nov 2023 Federal Reserve issues FOMC statement

- The Decisions Regarding Monetary Policy Implementation Implementation Note issued September 20, 2023

- FOMC – Meeting calendars, statements, and minutes (2018-2024)

- CNBC News – Fed holds rates steady, upgrades assessment of economic growth

- Reuters News – Fed keeps rates unchanged, Powell hedges on possible end of the tightening campaign

- Financial Times News – US Federal Reserve holds interest rates at 22-year high

Full FOMC press conference

Disclaimer

- Any finance-related information shared is not professional legal, tax, or investment advice.

- The information provided is of an educational and general nature and is not investment advice within the meaning of Articles L. 321-1 and D. 321-1 of the French Monetary and Financial Code.

- Investment carries risks of loss and past performance does not guarantee future performance.