People often ask me about various options in France for savings, investments, tax reductions, etc. and it is one of the most common FAQs. So, I started sharing regular updates on my personal finance portfolio. This can serve as an excellent example for people, who are beginning their savings and investment journey. However, it should not be considered as any investment advice but just a sharing of some personal experiences.

Here is my investment portfolio updated in October 2023.

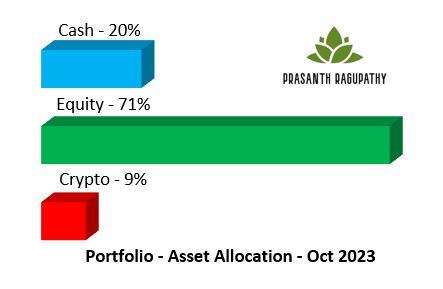

- My Target Asset Allocation: 75% in Equity, 20% in Cash, and 5% in Crypto, based on my current risk profile.

- My current asset allocation is shown below.

Here is an excellent article about asset allocation from Investopedia: What Is Asset Allocation and Why Is It Important? You can find detailed explanations of most of the topics mentioned further in the article and the personal experiences shared by other expats in a dedicated group India – France: Savings, Investments & Taxes – Discussions

An important piece of information is that I keep very little cash in current accounts. All the month’s fixed and variable expenses, monthly investments, etc are completed before the 15th of the month. So, I hardly keep around 100 euros in all my 4 current accounts combined.

Table of Contents

- Bank Accounts

- France & India

- Brokerage Accounts for Investments

- France & India

- Emergency Funds & Savings

- Equity Investment

- Retirement

- PERin : Plan d’épargne retraite – individuel

- Crypto Investments

- Income Tax Declaration

- France & India

- Assumptions & Notes

1. Banking Accounts

Let me start with the most obvious and basic thing required to maintain our personal finances every day. Of course, I am speaking about our bank accounts. In general, an average person requires 2-3 bank accounts to manage their various activities. If interested, you can open your accounts by clicking on the links below.

- Primary account(s) to receive salary, business income, manage loans, monthly fixed expenses, etc.

- Secondary account(s) for day-to-day expenses, groceries, online shopping, etc.

France

- Each bank account is meant for a specific purpose. Also, I try to use Apple Pay as much as possible to avoid any card scams, etc.

- I have never paid any banking charges in France because I had the BNP Paribas student account free for 3 years.

- All the accounts are completely online so I pay zero banking charges including the premium credit-cum-debit cards. Even the loan paperwork is done almost completely online.

- French online banks do not have any English-speaking customer care. But, almost everything can be done via the mobile app and the bank’s website. It is not a big issue but can test your patience sometimes.

- I can speak French, so I have zero complaints so far.

| Bank Accounts | Comments |

| Hello (primary) – current & savings account. DM for referral with your Email ID | Opened as a student account with BNP in 2015. Transferred to Hello in 2018. Has more features than Bourso and the 3rd largest online bank in Europe. |

| Bourso (primary) – current account. Referral Code: PRRA2704 | Salary account & monthly fixed expense payments. Largest online bank in Europe. |

| Revolut (secondary) – current account. | For groceries, online shopping, etc. French IBAN is available too. |

| N26 (secondary) – current account. | Opened up just for the experience. French IBAN is available too. |

India

- Non-resident Indians (NRIs) and PIOs are not legally allowed to maintain our resident bank accounts in India. These resident accounts must either be converted to Non-resident ordinary (NRO) bank accounts or closed.

- We can also open Non-resident External (NRE) bank accounts for sending our foreign income to India and use the NRO accounts for any income arising in India.

| Bank Accounts | Comments |

| HDFC (NRE) – savings acc. | For FDs, MFs, UPI payments, etc. Opened in India recently due to poor customer service from Kotak |

| HDFC (NRO) – savings acc. | For other uses in India |

| Kotak Mahindra (NRE) – savings acc. | Since 2018 & opened in France. For FDs, MFs, UPI payments, etc |

2. Brokerage Accounts for Investments

Here is a list of my various brokerage accounts which I use to invest in stocks, ETFs, mutual funds, and cryptocurrencies. If interested, you can open your accounts by clicking on the links below.

France

- These accounts have been chosen based on various factors including fees, functionalities, availability of required fund choices, etc.

| Banks / Brokerages | Accounts & Comments |

Boursedirect Referral code: 2020751090 | PEA. A primary investment brokerage account with tax advantages. |

| Bourso (primary) – current account. Referral Code: PRRA2704 | Assurance Vie (not life insurance) & PERin retirement savings account |

| Kraken | Cryptocurrency exchange. Returned from Binance. |

| CTO. Regular stock brokerage account |

India

- Currently, I am investing only in the Mutual Funds using funds from the NRE bank account. Planning to get into direct equities whenever possible.

- More details are in the Mutual Funds section below.

| Banks / Brokerages | Accounts & Comments |

| Kuvera + MF Central | For Indian Mutual Funds |

| Zerodha | Non-PIS stock brokerage account for NRIs. Planning to open soon. |

3. Emergency Funds & Savings

- Living in France provides certain financial stabilities even in the case of some worst life situations like unemployment, unplanned medical emergencies, etc.

- However, an emergency fund with 3-6 months worth of monthly expenses is highly recommended.

- I have kept them in very easily accessible savings accounts, which also offer some very good interest rates of up to 7.25 %. They are divided between India and France.

- This is another reason for keeping a very low balance in my current accounts.

France

- Tax-free bank savings Account (Livret A, LEP, etc)

- Assurance Vie – Fonds Euro (Cash)

India

- Fixed Deposits in NRE bank accounts.

- Though they are tax-free in India, we have to pay a 30% tax on the interest income to France.

4. Equity Investments

Finally, you have arrived at the most important component of my savings and investment portfolio.

- I am a very big believer in equity products with almost 88-89% of my portfolio invested in ETFs, stocks, crypto, etc. in the

- Most of my investments are usually planned for a very long time and a minimum horizon of 10 years. Also, I have another 30+ years for retirement.

- Though I have a very big risk appetite, I am neither interested in penny stocks nor meme-coins planning for the moon.

4a. PEA : Plan d’épargne en actions

- It is one of France’s best investment options available to tax residents. However, many people start directly with a regular brokerage account (CTO) and do not take advantage of certain tax benefits.

- Contains around 60% of my total portfolio.

- A PEA account allows us to invest in French and European stocks while benefiting from certain tax advantages.

- There are no yearly taxes on capital gains and dividends, as long as we do not withdraw our funds from the account.

- Limited to 1 account per tax resident in France and the total investment limit is capped at 150k euros. However, this limit does not apply to the capital gains and dividends earned inside the account.

- After 5 years of account opening, only the social charges of 17.2% are applicable on the capital gains instead of the usual 30% flat tax or taxed according to your tax bracket.

- However, there is no tax advantage when the funds are withdrawn before the end of 5 years. Also, the account will be closed.

- I have set up a monthly auto-debit from my bank account to the PEA account and manually invest almost every month. A separate article on PEA will be added very soon.

| Stocks & ETFs | Weightage in PEA |

| Amundi MSCI World UCITS ETF – EUR (C) | 45% |

| Amundi PEA US Tech ESG UCITS ETF Acc (previously Nasdaq100) | 45% |

| French Dividend Stocks | 5% |

- Recently, Amundi updated a few ETFs like Nasdaq100, etc, and oriented them towards ESG themes (Environmental, Social, and Governance). What Is Environmental, Social, and Governance (ESG) Investing?

- You can learn more about the MSCI World index here ETF – MSCI World Index – Invest In 23 Developed Countries In A Single Transaction

- I will cover the changes done by Amundi and also a few other options for ETFs in various articles soon.

4b. Assurance Vie

Assurance Vie is one of the most used investment products in France, especially to transfer wealth between generations and also the annual tax rebates.

- It is not a Life Insurance product. A commonly misunderstood part by a lot of people including French citizens.

- Currently, I do not invest much in it, except the bare minimum required per year to keep the account active.

- When my PEA account crosses 75k euros in investments, I will gradually start focusing on this product.

- Tax advantage after 8 years of account opening and the investment can be withdrawn anytime.

- You can find more details here What is an assurance-vie? and I will cover this topic in detail very soon.

| ETFs & Fonds Euro (Cash) | Weightage % |

| Lyxor S&P 500 ETF D EUR | 88% |

| Fonds en Euros (Euro Exclusif) | 12% |

4c. CTO : Compte Titres Ordinaire

A CTO is a basic stock brokerage account without any specific tax advantages.

- It should be preferred for non-European stocks only.

- Some brokers allow automated monthly investments.

- I find these accounts very interesting for some top American dividend stocks.

- I have finally settled with Interactive Brokers & Trade Republic after personally exploring other brokers like DEGIRO, Etoro, Trading212.

- Until Dec 2022, I had a 2k euros CTO portfolio with 18-20 American dividend stocks. But, I had almost liquidated the account and transferred all the funds to my PEA account.

Support This Blog!

If you’ve found my articles helpful, interesting or saving your time and you want to say thanks, a cup of coffee is very much appreciated!. It helps in running this website free for the readers.

4d. Mutual Funds in India

Even though I do not live in India now, I completely believe in the India growth strategy. So, I removed the Emerging Markets ETF from my portfolio and reallocated completely towards the mutual funds in India.

- I follow a mixed strategy of automated monthly SIPs (like DCA) in these funds and also do lump sumps manually whenever possible.

- It is a small component of my overall investment portfolio.

| Direct Indian Mutual Funds | Weightage % |

| UTI Nifty Index Fund-Growth Option- Direct | 63% |

| Tata Digital India Fund Direct Growth | 37% |

5. Retirement

An introduction to the French retirement system is explained on the CLEISS website.

In France, private-sector employees’ basic pensions are topped up by the compulsory supplementary pension scheme Agirc-Arrco, which is also financed on a pay-as-you go basis.

- The detailed article from CLEISS explains this topic The French Social Security System III – Retirement

- You can find your pension retirement rights, do simulations of retirement pension, trimesters accumulated, etc via the govt website www.lassuranceretraite.fr

- In addition to this mandatory pension scheme, it is good to invest in your own private retirement savings account like PERin explained below.

PERin : Plan d’épargne retraite – individuel

- Target date mandate system and so currently investing 100% into equity ETFs with 54% of funds invested in Europe.

- Will automatically rebalance to 100% debt towards retirement age.

- Highly recommended for people in the 30% tax bracket (TMI) and above.

- May not be useful for people in the 11% tax bracket and below.

- Reduces Tax now but the funds are blocked until retirement.

- Only account which is under “Gestion pilotée” mode. It means that investment options like ETFs, bonds, etc are chosen by the brokerage according to our risk profile.

- I have explained about PERin with all the details here PER – Plan Epargne Retraite : French Retirement Savings Account And Tax Reduction

6. Cryptocurrency

I have been investing in cryptocurrencies since 2021 and I do believe in this sector.

- I have seen huge oscillations on both sides and this helped in knowing by overall investment risk profile.

- In 2023, I have not added any funds to the portfolio but the weightage increased from 6% to 9% due to the current market conditions.

- I do not DCA into cryptocurrencies but invest during the bear markets.

- Staking generates additional value to the portfolio. It is like bank interest.

- Will reduce the exposure back to 5%, during the next bull run and move funds to the PEA account.

- I had the portfolio in Binance until June but I have now transferred almost everything back to Kraken.

- Cryptocurrencies are one of the most volatile investments and the weightage % given below keeps changing daily. However, I prefer to keep around 50% in Bitcoin.

- These are some of the top currencies based on their market cap and I do not get into any memecoins or the ones planning for the moon.

| Cryptocurrency Portfolio | Weightage % |

| Bitcoin | 49% |

| Ethereum | 5% |

| Cardano | 17% |

| Solano | 23% |

| Polkadot | 7% |

| Ripple | 0.1% |

7. Income Tax Declaration

As someone doing savings and investments in two countries, I complete my annual income tax declaration in France and India.

France

Income tax declarations in France are done every year between April to June, depending on where we live in France or its foreign territories.

- I will be adding a lot of detailed tax-related articles before the next tax season in 2024

- Revenu fiscal de référence (RFR) available from the tax returns “Avis d’impôt” is used to calculate the eligibility criteria for so many social benefits in France.

- This is another important reason why I keep encouraging even students to submit an income tax declaration.

- A few helpful articles and videos on taxes written so far on this blog are added below.

- How To Calculate Your French Income Tax In 7 Basic Steps?

- FAQ – Can I Declare The Money Transferred to My Dependant Parents?

India

I submit income tax declarations online before 31st July every year.

- ITR-2 for NRIs not having income under the head Profits and Gains of Business or Profession. This is my case.

- ITR-3 for NRIs having income under the head Profits and Gains of Business or Profession.

- If you are living abroad but have some investments in India or going to inherit something in the future, it is highly recommended to do an income tax declaration.

- If you are not earning anything currently in India, you can still submit a zero-income tax declaration. ITR2 hardly takes 5 minutes to complete and it will be helpful in the future.

- For more information, Returns and Forms Applicable for Non-Resident Individual

8. Assumptions & Notes

- This portfolio includes only the savings and investments done using my salary income. It does not include any inheritance from the family.

- I do Income Tax declarations in India and France.

- The average EUR/INR Rate used is 85 rupees and done via Wise (previously known as Transferwise)

- Annual Inflation Growth at 7% and expected CAGR of 12%.

- Blocked funds can be withdrawn earlier, based on some specific reasons.

- I have not mentioned the % of capital invested, profit/loss info, CAGR, etc.

- Took me 3 years to understand various things and countless discussions with a few ppl. Includes a lot of trial/error over these years to finally arrive at this portfolio.

- I don’t know where I will be after 3-5 years. So, no point in thinking too much about it. Wasted some precious time thinking about these things.

- Knowing French helped a lot, especially in understanding the French tax calculations & financial documents.

- Couples should figure out their risk capacity together. So, I might have to consider it when I get married & patiently explain all these things to my future partner. This is very important and will have a huge impact on the financial situation. I have seen so many couples struggling with this aspect.

Thanks for reading until here. Feel free to add your suggestions, questions, etc. in the comments.

Support This Blog!

If you’ve found my articles helpful, interesting or saving your time and you want to say thanks, a cup of coffee is very much appreciated!. It helps in running this website free for the readers.

Sources & References

- Taux d’usure (maximum interest rate)

- PER – Plan Epargne Retraite: French Retirement Savings Account And Tax Reduction

- Loans – What is peer-to-Peer (P2P) lending? Should i declare?

- US Federal Reserve Pauses Interest Rates Again – Nov 2023

- ETF – MSCI World Index – Invest In 23 Developed Countries In A Single Transaction

- FAQ – Double Tax Avoidance Agreement (DTAA) Between France And Various Countries

- Do you know the various tax-free savings accounts in France?

Disclaimer

Any finance-related information shared is not professional legal, tax, or investment advice. The information provided is of an educational and general nature and is not investment advice within the meaning of Articles L. 321-1 and D. 321-1 of the French Monetary and Financial Code. Investment carries risks of loss and past performance does not guarantee future performance. You should consult a financial advisor for any professional advice.

Thank you so much bro for sharing such detailed insights into your investments in France! Your transparency and thoroughness are truly appreciated. This information has been an eye-opener for me, providing valuable perspectives that will undoubtedly guide my own financial decisions. Grateful for your generosity in sharing your experiences!

Thanks a lot for your kind feedback bro

Hello Prasanth

Thanks for your page.

If I have understood correctly, can we invest in ETF through opening an account in Boursedirect or invest brokers ?

Kind regards

Chari

Hello Chari,

Depends on the type of ETF. Its better to start with the PEA account and ETFs in it. Then you can explore other ETFs via the CTO account

Hello Prasanth

Thank you for sharing such a detailed information and that too your real time experiences. Thank you once again for your time and efforts put into this.

Kind Regards

Aswathy.